What Is US Connect Charge On Bank Statement?

If you have come across an unfamiliar fee listed as US Connect on your bank’s statement or credit card and are pondering what it signifies here you will obtain a thorough manual about it. If a US Connect charge is exhibited on your bank statement that indicates that you have purchased by way of the US Connect system of automated retailers and mini markets.

When you purchase a snack beverage or pre prepared meal from a US Connect vending machine or mini marketplace using your debit or credit card they charge a payment on your card for the item. Then several days later your bank report will exhibit a transaction from US CONNECT with the amount you spent.

If you have also been charged a US Connect on your credit card there is no need for concern. It is a legitimate charge appearing on your bank statement.

Why did US connect charge appear on my bank statement?

Have you ever made a quick purchase from a vending machine only to later notice an unfamiliar charge from US Connect? You’re not alone, many people see this charge and wonder what it’s for. US Connect is a payment processing network that powers micro markets and vending machines across the country.

When you use your debit or credit card at one of these automated retailers your payment goes through US Connect. Also the charge may not always pop up immediately. US Connect first puts a temporary hold on your funds until the transaction is fully processed. This generally takes a few business days.

In the meantime if you check your statement you may see the mysterious US Connect charge before the purchase fully clears. It’s simply a placeholder charge until the payment is finalized between your bank and US Connect.

Don’t worry this charge does not mean any unauthorized activity. US Connect is legitimately collecting payment for the item you purchased days earlier at a vending machine. They act as the middleman to facilitate payments from millions of cardholders to various retailers nationwide.

The next time you see US Connect on your statement you’ll know there’s no cause for concern. It’s simply the backend payment system catching up to the on the go convenience you enjoyed from a vending machine.

How do US Connect charge Appear on Statements?

US Connect charge will surface on your financial report within a few days of creating a purchase from one of their automated retailers or microeconomics. The charge will feature the name US Connect” somewhere in the details so you recognize where it originated.

When you use your payment card at a Global Mart vending machine micro market or other self checkout station your transaction is processed through their payment network. This network Global Mart facilitates transactions between merchants and customers.

While the purchase is instant it takes a few days behind the scenes for the full payment process to finalize. In the interim US Connect will place a temporary authorization on your funds. Then within a few business days the actual charge from US Connect appears on your statement.

This lets you know your payment was successfully processed through the bank statement system. So the next time you see their name while reviewing recent expenditures you’ll understand its purpose and need not be concerned. The charge simply represents items obtained days prior through the automated selection stations they support worldwide.

What is US Connect charge on bank statement or credit card?

Have you recently noticed an unfamiliar charge listed as what is US Connect charge on bank statement or credit card? on your bank statement or credit card bill. You’re not alone as this is a common occurrence that often raises questions.

When you use your payment card to make a quick purchase from a vending machine or micro market using your debit or credit card your transaction is routed through the US Connect network. In the following days you may see a temporary charge from US Connect before it fully clears. This is simply a placeholder placed by US Connect to authorize funds for the purchase you recently made through their widespread automated payment system.

Origins and Purpose of US Connect charge

The US CONNECT charge began appearing on bank statements in 2021. This new fee was implemented by the large banking organization Visa to help support updates to the payment infrastructure. Visa processes billions of transactions each year for customers and banks. To keep operations running securely and smoothly requires ongoing technology improvements.

The purpose of the US CONNECT charge is to fund Visa’s workplace upgrading their core processing network behind the scenes. By modernizing their systems Visa aims to provide consumers and businesses with faster, more convenient digital payment options now and into the future. The fee also helps cover the rising costs of preventing cybercrime and protecting personal financial data during each swipe tap or online purchase.

Categories of Services Covered by US Connect charge

The US CONNECT fee helps support several important payment services behind the scenes. It allows Visa to update their transaction routing infrastructure to ensure purchases are quickly approved and funds are securely transferred between banks.

The money also funds projects to enhance fraud monitoring tools and roll out new authentication methods like biometrics. From maintaining fast credit and debit card networks to developing better account protections the categories covered aim to keep transactions safe, simple and uptodate for all users.

Identifying US Connect charge Transactions on Bank Statements

The US CONNECT fee will appear as a separate line item on monthly banking statements. It will be labeled clearly as the US CONNECT Charge followed by the amount. This makes it easy for customers to distinguish from regular purchases, deposits or withdrawals. The charge is assessed at the end of each statement cycle by the bank that issues the debit or credit cards.

Customers may see multiple small US CONNECT charges if they have several qualifying accounts such as multiple credit cards. But the fee is capped at a maximum of $0.20 per account each cycle. Checking account statements will bundle all associated debit and credit card charges together under one line. This consolidation offers transparency while keeping financial reviews straightforward.

Validity and Legitimacy of US Connect charge

The US CONNECT fee imposed by Visa has faced some questions from customers. Also it is considered a legal and valid cost by federal regulators. Visa properly disclosed the new charge to banks and merchants in advance.

As long as the funds go toward maintaining secure payment networks as intended the fee complies with requirements. While unwelcome most see it as a nominal cost for valuable services consumers rely on everyday.

Ways to Prevent US Connect Bank Charges

There are a few ways customers can try to avoid the small monthly US CONNECT fee. Using cash instead of debit cards for purchases may help. One can also consider lowering credit or debit card usage and payments to dip below the activity level needed to trigger the charge. Of course minimizing digital payments means losing out on various rewards too. Examining these options further:

Freeze Credit Reports if Cards Are Lost or Stolen

Losing a wallet with credit cards inside brings risk. Identity thieves can make purchases before cards are blocked. Freezing credit reports prevents new accounts fraudulently opened. A PIN allows freezing and unfreezing as needed through each agency.

Equifax Experian and TransUnion offer freezes. Call or apply online with IDs as proof. Fraudulent activity becomes impossible without consent to lift freeze first. People control access finding peace of mind protection exists if ever cards fall into wrong hands.

Opt-Out of Overdraft Protection on Debit Cards

Overdraft fees punish those without a cushion. Banks market protection but charge dearly per declined transaction. Without consent discretionary coverage kicks in risking high penalties.

Requesting no overdraft protection provides security. Required funds must exist or purchase declines with no fee assessed. People gain control avoiding expensive surprises and easier managing account balance.

Consider Setting Spending Limits on Credit Cards

- Decide on a reasonable limit based on your income and expenses. Don’t base it on the maximum limit offered by the credit card company. Consider your regular bills and a comfortable amount left over for nonessentials or emergencies. Being realistic prevents getting in over your head with debt.

- Communicate the limits to yourself so you’re conscious of spending habits. Write it down or set reminders on your statement dates. Out of sight is out of mind and it’s easy to forget how much you’ve charged without limits. Staying aware keeps you from charges you can’t comfortably pay off each month.

- Periodically reevaluate the limits as needs change. Life circumstances like a job loss or new family expenses may warrant lowering the credit limit initially. Over time, financial growth limits can increase accordingly. Flexibility helps credits work for you rather than against you.

- Don’t see the limits as deprivation but financial freedom. Discipline around sensible restrictions protects long term interests over short term whims. Overall financial stability far outweighs any single purchase or experience. Spending limits promote responsible credit management for years to come.

Sign Up for Transaction Alerts via Email or Text

It’s smart to sign up for text or email alerts from your credit card company. This way you get notified right away about any purchases on your card. Staying on top of charges helps you watch your spending and catches unauthorized activity early. Transaction alerts let you actively monitor your account with ease.

Review Accounts for Unauthorized Charges

Make checking statements part of your routine. Skimming for abnormal charges is faster than poring over details. Unfamiliar transactions could indicate identity theft needing action. Quick scans safeguard your finances seamlessly.

If anything looks off, dig deeper. Compare receipts to verify amounts and businesses. Report unauthorized entries right away to challenge fraudulent actions promptly. Taking ownership prevents others from misusing your accounts casually.

Methods to Stop or Reduce US Connect charge

Speak to your provider politely about usage based billing or changing plans. Explain your situation with empathy and ask for options to better manage costs moving forward.

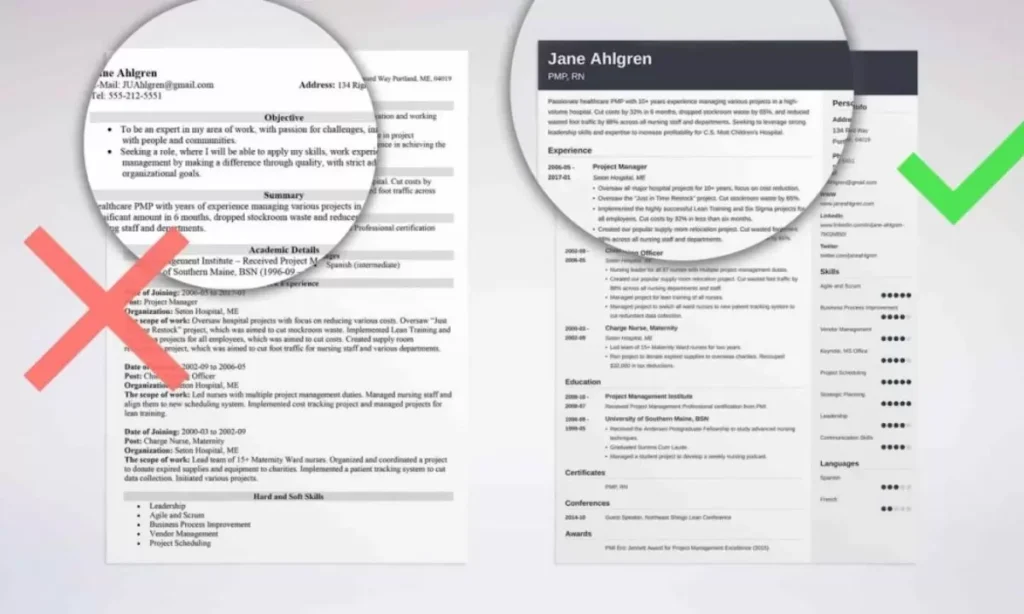

Monitor Bank Statements Regularly

It is important to check your bank statements regularly. You should review them at least once a month. This allows you to catch any errors or fraudulent transactions promptly.

Monitoring statements helps you manage your finances well. You can track your spending habits and income. It also helps you save more by staying aware of where your money is going each month.

| Frequency | Purpose | Benefits |

| Monthly | Catch errors fraudulent transactions track spending habits | Identify problems early disputed can be raised in time |

| Weekly | Get a better sense of all your transactions income and expenses for tighter money management | Stay on top of cash flow watch for patterns that can help adjust spending |

| Daily | For account with frequent transactions | Catch small errors or fraudulent charges right away before they become bigger issues |

| At time of transaction | For online purchases or withdrawals | Verify details of transaction made by you spot issues instantly |

| Instant alerts for certain transactions | May be for transactions over a set limit or recurring payments | Get notifications on phone helps monitor account activity in real time for added security |

Report Unauthorized Transactions Immediately

It is important to review your statements carefully for any unfamiliar transactions. If you notice any charges you didn’t act fast. The sooner you report it the better chance of getting your money back.

Do not hesitate to contact your bank right away about any unauthorized activity. Explain what transactions are not recognized calmly. The representatives are there to help resolve matters quickly so you don’t lose money. They can also provide guidance on important steps to take like freezing the account if needed. Immediate action helps reduce fraud and protects your hard earned savings.

Use Credit Cards Instead of Debit Cards for Online Purchases

When shopping online it’s safer to use credit instead of debit cards. In case of any fraudulent charges credit cards offer dispute protections. You may not lose your own money while issues are resolved.

With debit cards your checking account is directly linked. Fraudulent transactions cause immediate losses from your balance. Credit cards act as a buffer until problems are fixed. Being cautious helps avoid post purchase hassles that ruin online shopping fun.

FAQ’s

Conclusion

What is the US Connect charge on the bank statement? US Connect is a payment processor for automatic monthly payments using your debit card details. Checking your statements regularly and knowing recurring authorized charges can help you easily identify any unexpected or fraudulent transactions on your account. Taking action promptly on unauthorized activity and contacting your bank or merchant to cancel recurring payments you no longer need helps you maintain good control of your finances.