What Is PayPal Instant Xfer Charge?

The PayPal Instant Xfer Charge is a fee applied when you choose to instantly transfer funds from your PayPal account to your bank account or debit card. This charge is typically 1% of the transferred amount, capped at a maximum fee (e.g., £10). It is imposed for the convenience of receiving money immediately, rather than waiting for the standard transfer period of 1-3 business days.

What Is PayPal Instant Xfer Charge?

PayPal Instant Xfer Charge refers to the fee PayPal imposes when you opt for an instant transfer of funds to your bank account or debit card. This fee is charged for the convenience of transferring money immediately rather than waiting for the standard 1-3 business days.

Why Does PayPal Charge This Fee?

The fee for instant transfer exists because PayPal incurs costs for processing these transactions in real-time. When you choose an instant transfer PayPal utilizes the networks of banks and card processors to ensure the funds are available immediately. This service requires PayPal to pay a premium which is then passed on to the user.

How Much Is the PayPal Instant Xfer Charge?

The fee structure for PayPal Instant Xfer varies depending on the type of account and the destination of the funds:

- To a bank account: Typically, 1% of the amount transferred capped at a certain maximum fee.

- To a debit card: Similar to bank transfers, usually 1% of the transfer amount.

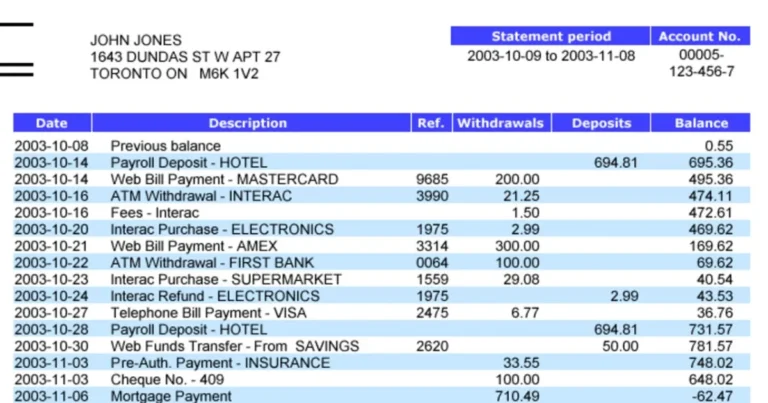

Here’s a quick comparison:

| Transfer Method | Fee Rate | Maximum Fee |

| Bank Account | 1% | £10 |

| Debit Card | 1% | £10 |

Note: These fees are subject to change based on PayPal’s policies and user agreements. Always check the latest fee schedule on PayPal’s official website.

Case Study: Immediate Fund Transfer Benefits

Consider Sarah, a freelance graphic designer who needs quick payments for her services. When a client pays her via PayPal, she often needs the money right away to cover her expenses. Opting for the PayPal Instant Xfer Charge Sarah can access her funds immediately rather than waiting for the standard transfer period. This convenience although at a cost helps her maintain cash flow and manage her finances effectively.

How To Stop PayPal Inst Xfer?

If you’re finding the PayPal Instant Xfer Charge too costly there are ways to avoid or reduce these fees:

1. Opt for Standard Transfers

The most straightforward method to avoid the instant transfer fee is to use the standard transfer option. Although it takes 1-3 business days it comes without the additional cost.

2. Link a Bank Account Instead of a Card

Transfers to bank accounts often have lower fees compared to debit cards. By linking your bank account to your PayPal you can reduce the transfer cost even if you occasionally opt for instant transfers.

3. Plan Your Transfers

Planning your transfers ahead can help you avoid the urgency that necessitates instant transfers. By scheduling regular fund withdrawals you can rely on standard transfers thus avoiding the instant transfer fees.

Steps to Disable Instant Transfer

To ensure you do not accidentally choose the instant transfer option follow these steps:

- Log in to your PayPal account.

- Go to the Wallet section.

- Select the bank account or card you usually transfer funds to.

- Choose the transfer option and opt for the standard transfer.

Tip: Regularly reviewing your transaction history can also help you keep track of any fees incurred and adjust your transfer habits accordingly.

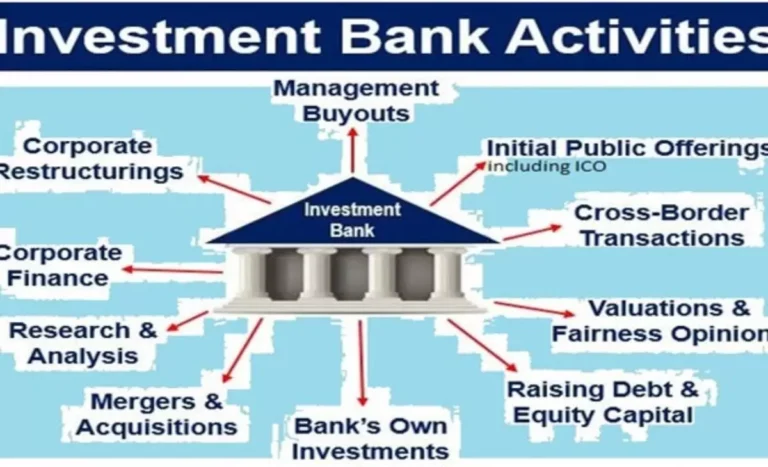

Get Daily Crypto Insights

While managing your PayPal transactions, staying informed about the latest in financial technology including cryptocurrencies, can provide additional benefits. Many platforms offer daily insights and updates on the crypto market, helping you make informed decisions about your investments and financial strategies.

Why Stay Informed?

- Market Trends: Understanding market trends can help you identify the best times to buy or sell.

- Investment Opportunities: Daily insights can reveal new and emerging opportunities in the crypto space.

- Risk Management: Staying updated allows you to manage risks better and make strategic decisions.

Example: Subscribing to newsletters from reputable financial websites or following industry experts on social media can keep you abreast of the latest trends and insights.

How To Avoid PayPal Inst Xfer Charges

1. Use Direct Deposits

Whenever possible opt for direct deposits to your bank account. This method can bypass the PayPal platform entirely for receiving payments thus avoiding PayPal’s transfer fees.

2. Explore Alternative Payment Platforms

Consider using other payment platforms that offer lower fees or free transfers. For example, platforms like Venmo Zelle or direct bank transfers might offer better terms depending on your needs.

3. Maintain a PayPal Balance

Keeping a PayPal balance and using it for online purchases can minimize the need for frequent withdrawals. This way, you avoid the instant transfer fees altogether by leveraging your PayPal funds directly.

4. Use PayPal’s Friends and Family Option

For personal transactions, using PayPal’s Friends and Family option can avoid the fees associated with business transactions. This should only be used for personal transfers to avoid violating PayPal’s terms of service.

Table: Comparing PayPal and Other Platforms

| Feature | PayPal Instant Transfer | Standard Bank Transfer | Venmo | Zelle | Direct Deposit |

| Fee | 1% (capped) | Free | Free | Free | Free |

| Speed | Immediate | 1-3 Business Days | Instant | Instant | Varies |

| Ease of Use | High | Moderate | High | High | High |

| Accessibility | Widely Used | Widely Used | Limited | Limited | Employer-specific |

Is PAYPAL INST XFER TEMU WEB ID: PAYPALSI77 Fraud?

Encountering unexpected charges or transactions labeled PAYPAL INST XFER TEMU WEB ID: PAYPALSI77 can be alarming. Here are steps to identify and handle potential fraud:

1. Review Transaction Details

First, carefully review the details of the transaction. Check the date amount and recipient information. Sometimes legitimate transactions can appear suspicious due to unusual labeling.

2. Contact PayPal Support

If you suspect fraud immediately contact PayPal support. They can help verify the transaction and initiate any necessary dispute processes.

3. Monitor Your Account

Regularly monitor your PayPal account for any unusual activity. Setting up alerts for transactions can help you catch fraudulent activities early.

4. Update Security Settings

Ensure your PayPal account security settings are up-to-date. Enable two-factor authentication (2FA) to add an extra layer of protection against unauthorized access.

FAQ’s

Conclusion

Understanding the PayPal Instant Xfer Charge is essential for managing your finances efficiently. This fee imposed for the convenience of immediate fund transfers can add up especially if used frequently. By opting for standard transfers linking a bank account instead of a card and planning your withdrawals you can avoid or reduce these charges.

staying informed about your account activities and recognizing potential fraud indicators such as PAYPAL INST XFER TEMU WEB ID: PAYPALSI77 helps protect your finances. With these strategies, you can effectively manage your PayPal transactions while minimizing unnecessary costs.