What is Restructuring Investment Banking?

Restructuring investment banking refers to the services provided by investment banks to help struggling companies restructure their debt obligations, capital structure, operations or organization when facing financial distress.

Investment banks act as advisors and help guide negotiations between the company and its creditors/investors to arrive at a viable solution and ensure the long term viability of the business.

Types of Restructuring

There are different types of restructuring based on the nature of changes required:

Financial restructuring

Modifying a company’s capital structure by negotiating new debt obligations, interest rates repayment schedules with creditors.

Operational restructuring

Improvements to core operations like cost-cutting, efficiency gains, portfolio re-alignment to boost cash flows.

Organizational restructuring

Changes to management, strategy, business model or divesting non core assets to refocus the company.

Asset restructuring

Selling off non core or underperforming assets to raise cash or repay debt.

The goal is to reduce debt, lower expenses and position the company for future profitability and stability. Investment banks play an advisory role in all types of restructuring scenarios.

The Process of Restructuring in Investment Banking

The restructuring process typically involves the following key steps:

- Initial assessment of the company’s financial situation, debt obligations, liquidity problems by the investment bank.

- Developing restructuring strategies and options – ranging from operational changes to outright bankruptcy.

- Leading negotiations between the company and relevant creditors like banks holding the highest term loan, bondholders holding the largest unsecured notes.

- Arriving at an agreement to reduce debt load, interest costs and relax covenants through techniques like debt-for-equity swaps.

- Implementing the restructuring plan, operational changes, new financing and emergence from financial distress.

- Ongoing monitoring and advisory support during the turnaround phase.

The goal is to ensure long term viability and create a stronger financial foundation for future growth. It’s a complicated process requiring experienced guidance from restructuring investment bankers.

Role of Investment Banks

Investment banks play a critical role in restructuring as:

- Strategic advisors guiding negotiations between the company and its creditors/investors.

- Providing objective valuations of the company’s assets and debt paying ability.

- Structuring new financing plans involving debt refinancing debtor in possession facilities.

- Managing the complex restructuring scenarios and restructuring deals.

- Liaising between the company, creditors, vendors, advisors throughout the process.

- Ensuring a fair outcome for all parties that maximizes value and avoids outright bankruptcy if possible.

Their expertise in both traditional M&A banking and distressed situations is invaluable for achieving successful restructurings.

Impact and Benefits of Restructuring

When done right, restructuring can deliver significant benefits by:

- Reducing the debt burden to a sustainable level matching the company’s cash flows.

- Lowering interest costs and relaxing covenants to boost financial flexibility.

- Streamlining operations and focusing on core profitable business lines.

- Retaining jobs, business relationships and the company’s role as a going concern.

- Providing creditors with an orderly debt repayment process versus dissolution in bankruptcy.

Overall, the goal is to give the company a second lease on life with a stronger foundation for long-term profitability versus liquidation.

Case Studies and Real-World Examples

Some notable restructuring examples include:

- Neiman Marcus Filed for Chapter 11 in 2020 aided by Kirkland & Ellis LLP and Lazard. Emerged with over $2B in debt relief.

- Sears Restructured out of court in 2003 negotiated by Lazard. Later declared bankruptcy in 2018 after operational issues.

- Tribune Media Exited Chapter 11 in 2017 after $7B debt restructuring led by Evercore and JP Morgan.

- Caesars Entertainment Successfully reorganized debts exceeding $18B in 2017 with advisers like Milbank.

These high-profile cases illustrate the role of investment banks and advisors in navigating complex restructurings of even some of the largest distressed companies.

The Restructuring Timeline

The restructuring process usually follows this general timeline:

- 6-12 months before distress

- Initial signs of underperformance emerge like declining revenues, margins.

- 3-6 months before distress

- Liquidity problems appear, creditors get concerned about debt servicing ability.

- Distress

- Missed debt payments, covenant defaults trigger technical default. Restructuring advisor appointed.

- 0-3 months

- Urgent restructuring needed, strategic options evaluated, negotiations begin.

- 3-6 months

- Terms negotiated with creditors, restructuring agreement finalized, capital raised.

- 6-12 months

- Exit from restructuring, business stabilized with new capital structure and performance tracked.

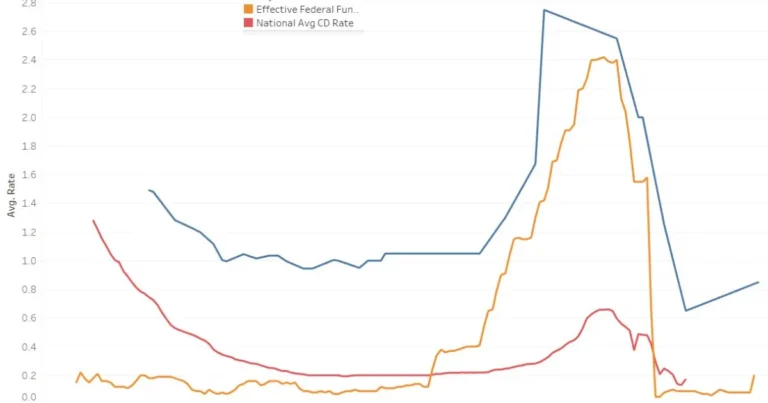

The timelines can vary significantly based on debt levels, economic cycles and complexity of the restructuring solution.

The Signs of Corporate Distress

Some common warning signs that a company may be heading towards financial distress include:

Limited or Diminishing Liquidity

- Inability to meet payroll or vendor payments

- Delaying supplier payments

- Cutting discretionary expenses

Maturity Walls Approaching

- Near-term debt maturities exceeding available cash

- Refinancing risk as financial position weakened

Debt Trading Level Declines

- Junk bond yields rising rapidly

- Loan prices falling in secondary market

These early signs help restructuring investment banks begin initial advisory work to explore options before a crisis emerges. Early intervention improves outcomes.

Restructuring Investment Banks and What They Do

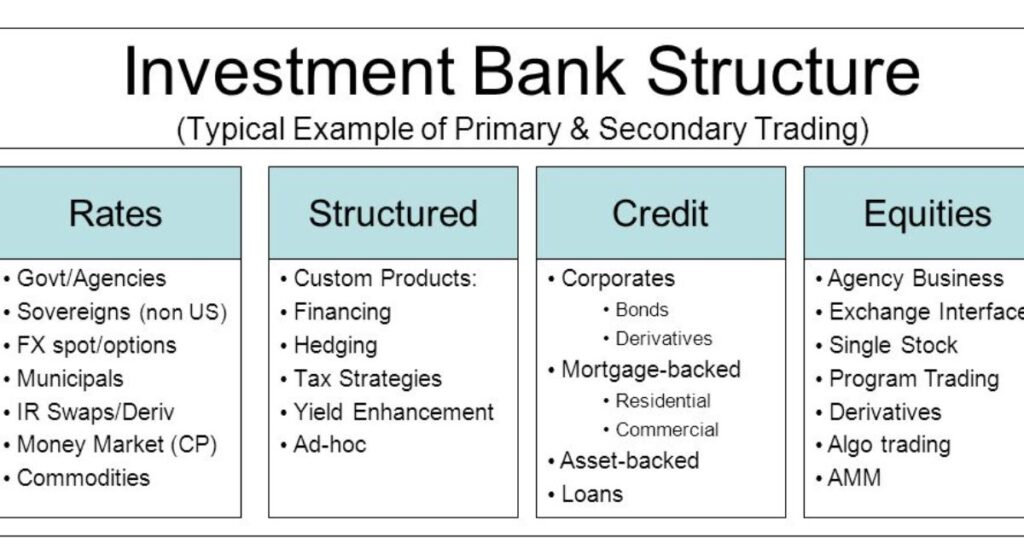

Leading investment banks have dedicated restructuring groups comprising specialized professionals and financing sources for distressed situations.

In-Court vs. Out-of-Court Restructuring

- In-court Filing for Chapter 11 bankruptcy protection to bind all creditors.

- Out-of-court Voluntary negotiation outside of bankruptcy court. Preferred due to stigma and costs.

The Case of Neiman Marcus

Neiman Marcus filed for bankruptcy in 2020 during COVID-19 with Berkshire Hathaway and PIMCO agreeing to provide $675M in debtor in possession financing.

TLB Restructuring

TLB (term loan B) loans are often restructured via amendment extending maturities and reducing interest costs in exchange for additional collateral or fees.

Unsecured Notes Restructuring

Notes traded at a steep discount can be voluntarily exchanged for equity or new debt at favorable rates through a tender offer negotiated out of court.

Restructuring Solutions Summary

In summary, experienced restructuring bankers devise customized strategies considering debt obligations, the company’s situation and creditor interests to arrive at an optimal solution maximizing value for all parties involved. The key is to prevent liquidation and give the troubled company a viable future.

FAQs

What does restructuring mean in Investment Banking?

Restructuring refers to the services provided by investment banks to guide troubled companies negotiate changes to their capital structure, debt obligations or operations when facing financial distress.

What is the concept of restructuring?

Restructuring involves revamping a company’s finances and operations to resolve problems like high debt levels, liquidity crunches or underperformance that threaten its viability.

What is the difference between restructuring and M&A?

While both involve analyzing a company’s financials and advising on strategic options, restructuring deals with solving existing problems versus M&A which focuses on growth through transactions like mergers, acquisitions or divestitures.

What are the top investment banks restructuring?

Top restructuring specialists include boutiques like Houlihan Lokey, Lazard, Moelis & Company along with bulge bracket banks with large restructuring teams like JP Morgan Bank of America Merrill Lynch Citigroup Goldman Sachs.

Final Thoughts

Restructuring is a complex but critical process for guiding troubled companies navigate financial distress and stabilize operations. It aims to give businesses a viable future through customized solutions preserving jobs and stakeholder value.

Experienced restructuring investment banks play a pivotal advisory role with their expertise in negotiating complex scenarios on behalf of their clients. Their specialist knowledge and industry relationships are invaluable for achieving successful outcomes.