What Is the MSFX Charge on Your Bank Statement?

The MSFX charge on your bank statement typically refers to a fee associated with foreign currency transactions. MSFX stands for Multi-Currency Foreign Exchange. This charge can occur when you make a purchase or withdraw money in a currency different from your account’s base currency. It may include conversion fees or transaction fees imposed by the bank or payment processor for handling the currency exchange. If you see this charge and don’t recognize the transaction it’s advisable to contact your bank for clarification.

What Is the MSFX Bank Charge?

The MSFX charge is a fee that may appear as a mysterious line item on your credit card or bank statement. MSFX stands for Marks and Spencer Financial Exchange, and it represents a foreign exchange service fee charged by some banks and credit card providers.

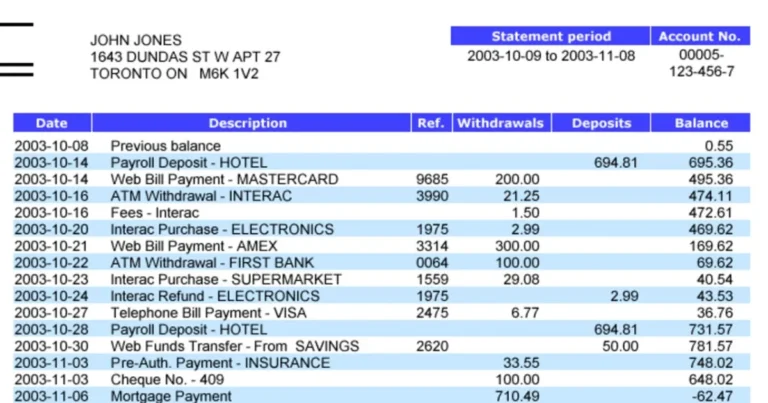

How the MSFX Charge Appears on a Bank Statement?

The MSFX charge will typically appear as a transaction made by MSFX or Marks & Spencer Financial Services. It might simply read as a generic term like FOREX FEE or FOREX CHARGE as well. The fee amount is usually relatively small ranging from a few pounds to around £5. However, it can be confusing to see unfamiliar charges appearing without explanation.

How to Handle the MSFX Bank Charge?

If you notice an MSFX charge on your statement here are some recommended steps to take:

Step 1: Identify the charge

Confirm that the charge is legitimate by cross referencing the transaction date and amount. Contact your bank if any details seem inaccurate.

Step 2: Understand the reason for the charge

Call or check your bank’s website for an explanation of what the MSFX fee represents and why you were charged. It’s usually for foreign exchange conversion of an international purchase or cash withdrawal.

Step 3: Take appropriate action

If you recognize the associated transaction then no further action may be needed. But you can ask your bank to waive the fee especially for a first offense to avoid future unexpected charges.

This covers the key aspects of defining MSFX charges how they appear and initial steps to take. In the next section we’ll discuss preventative measures and additional guidance.

How to Prevent MSFX Charges from Appearing?

There are a few proactive steps you can take to avoid unexpected MSFX fees:

- Opt into price exchange rate notifications from your bank for any foreign transactions. This ensures you’re aware of conversion costs upfront.

- Consider using a travel credit card for overseas purchases instead of your regular card. Many have no foreign fees and offer highly competitive exchange rates.

- Set travel notification preferences with your bank or credit card company so they’re aware of dates/locations and less likely to flag foreign activity.

- Pay in the local currency whenever possible to eliminate conversion charges rather than using your home currency card.

- Verify if fees may be waived for certain card types like rewards premium or business cards before assuming extra charges are unavoidable.

- Enable overseas transaction allowances on your accounts if they’re not already active to prevent blocks on valid international spending.

Staying informed about bank conversion policies and using the right account for each trip location helps bypass unnecessary MSFX and similar foreign exchange costs.

Understanding Unknown MSFX Bank Charges

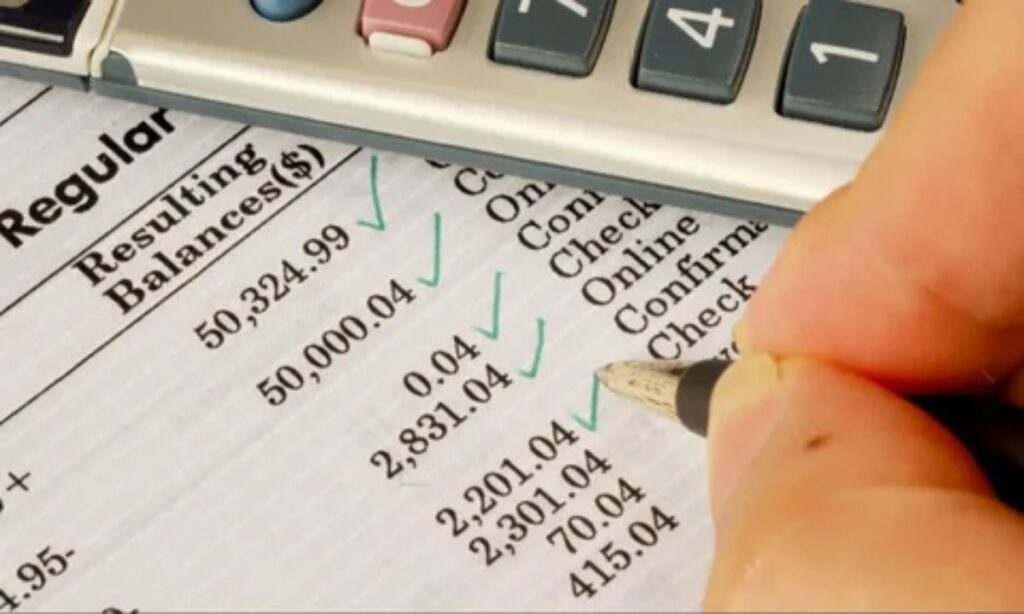

Seeing a mysterious fee appears can understandably raise concerns. However, unauthorized charges are actually quite rare. In most cases, the MSFX simply represents standard conversion fees unavoidably incurred by international transactions processed by the card network. A few clarifying calls usually explains the purpose. But it’s still wise to scrutinize statements for accuracy each month as a precaution, rather than ignore minor puzzling items.

When Does This Charge Typically Appear?

MSFX charges typically show up on credit card or bank statements within a month after an international purchase cash withdrawal or other cross border financial transaction. Specifically:

- For debit or credit card spending during travel abroad most issuers charge the conversion fee immediately and post it within a day or two on the statement.

- Cash advances and balance transfers with an exchange rate markup also see fees applied instantly and reflected promptly.

- Certain billing cycles may bundle accrued foreign charges into a single monthly fee rather than itemizing each one.

- Online banking platforms sometimes display real-time currency conversions without an MSFX charge but the fee still applies and appears separately on statements.

if an international purchase posts within 30-60 days before seeing the MSFX it likely relates to that activity. But banks can charge retrospectively for qualifying transactions up to 3 months old as well.

Why Does This Fee Show Up on My Statement?

MSFX charges exist because providing currency exchange services has back-end operational costs for banks and card networks. Specifically:

- Exchange rates have markup fees built in above interbank rates to cover infrastructure compliance accounting and partner bank fees.

- Additional handling charges offset processing of foreign authorization requests and settling cross-border payments.

- Risk assumed in fluctuating exchange rates before/after transaction date warrants additional profit margin.

While frustrating these fees are universal and help make international transacting feasible. Banks would either not offer or drastically limit such services without them.

Is This Charge Legitimate?

In almost all cases an MSFX charge is representing a valid foreign exchange fee rather than a fraudulent or erroneous deduction. Some signs it’s legitimate:

- Transaction date and amount match a recent overseas purchase or withdrawal.

- Bank terms and conditions disclose cross-border fees.

- Other cardholders commonly report similar MSFX charges.

- Bank confirms purpose upon request and shows proof in your account details.

It’s still advisable to monitor statements closely in case of errors. Particularly watch for:

- Charges with no matching international activity.

- Inconsistencies like multiple fees for a single transaction.

- Dates/amounts that don’t align with your payment records.

- Excessive fees significantly higher than disclosed percentages.

If anything seems off despite research report it to your bank immediately so they can investigate. Identity theft monitoring also ensures no unauthorized cards exist in your name. But typically, one small MSFX fee is nothing to overly worry about.

How to Avoid Future MSFX Charges?

Once an MSFX charge has been confirmed as legitimate and isolated focus going forward on:

- Switching to a travel rewards credit card without foreign fees when possible.

- Staying within overseas withdrawal limits to bypass ATM operator fees.

- Enabling expenditure alerts and real time currency conversions through banking apps.

- Budgeting a bit extra for purchases to offset inevitable conversion costs.

- Storing import country currency on multi country trips to minimize money exchanges.

With advanced planning factored in future international travel spending need not incur unexpected MSFX fees. Maintaining good records also helps address banks promptly if any erroneous charges occur.

FAQ’s

Is the MSFX charge a one time fee?

No, it applies to each qualifying foreign transaction.

What does MSFX stand for?

MSFX stands for Multi-Currency Foreign Exchange.

How much is the MSFX charge?

The fee varies but is usually a small percentage of the transaction amount.

Conclusion

In conclusion the MSFX charge on your bank statement refers to fees associated with foreign currency transactions. This charge standing for Multi Currency Foreign Exchange often appears when you make purchases or withdrawals in a different currency than your account’s base currency. It’s important to recognize and understand these charges to manage your finances effectively.

If you see an unfamiliar MSFX charge it’s prudent to contact your bank to verify its legitimacy and purpose. Proactively managing your spending habits such as using cards without foreign transaction fees and monitoring your account for real time currency conversion rates can help prevent unexpected MSFX fees in the future.