What are NWEDI Payments Flex Charges on your Bank Statement?

When you see an MSFX or NWEDI Payments Flex Charges, it’s typically linked to services or products that offer flexible payment options, allowing for more manageable and scheduled payments over time. This system is designed to facilitate smoother financial management for both the consumer and the provider. In essence, MSFX Charges and NWEDI Payments Flex Charges are a part of modern banking that enable easier and more flexible financial interactions.

Key Takeaways about NWEDI Payments Flex Charges

- NWEDI is an electronic payment network used by businesses to send and receive EDI payments.

- When payments are processed via NWED you may see flex charges or fees on your bank statement.

- Flex charges are small transaction fees applied by NWEDI to cover the costs of processing EDI payments securely.

- Typical flex fees range from $1 to $3 per payment transaction.

- Carefully reviewing bank statements helps identify and verify any NWEDI Flex charges.

- Dispute unexpected or unauthorized NWEDI charges with your bank promptly.

- Proper setup and communication can prevent mistaken flex charges between business partners.

- Understanding flex fees allows businesses to budget accurately for EDI payment costs over time.

- Regular reviews ensure NWEDI fees do not exceed agreed terms for efficient electronic payments.

What Are EDI Payments?

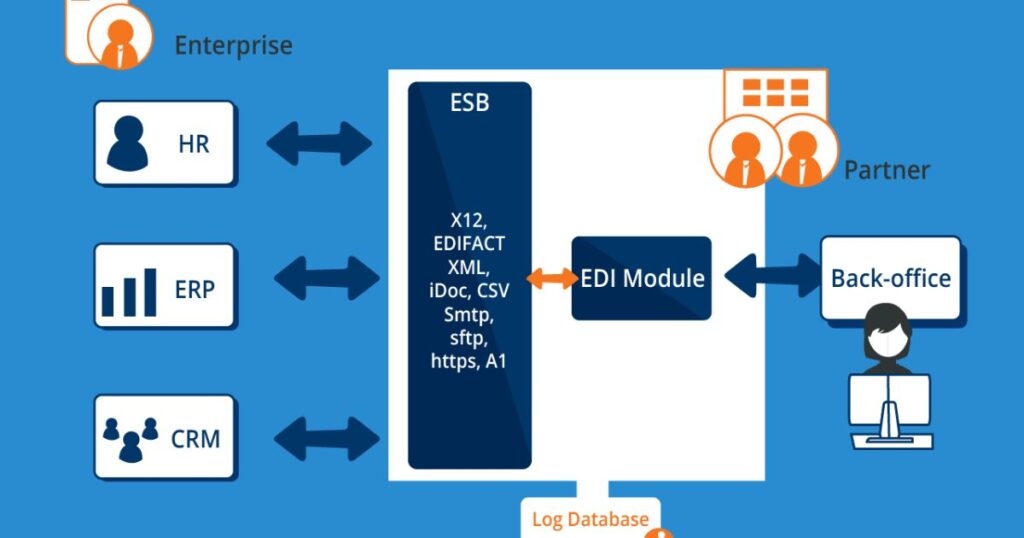

EDI stands for Electronic Data Interchange. NWEDI Payments Flex allows businesses to send and receive funds electronically through a secure network. Instead of using checks, an EDI payment involves transferring payment details like invoices between the buyer and seller as electronic files.

The payment is then deposited directly into the payee’s bank account. EDI payments use standardized digital formats and common protocols to facilitate payment transfers, often incurring Hft Epay Charges. Businesses set up their EDI systems to exchange purchase orders, invoices, and remittance advice electronically.

Types of EDI Payments

There are a few main types of NWEDI Payments Flex businesses can use. Direct EDI involves a direct transfer between the payer and payee’s banks. The payment clears immediately without needing to go through the ACH network.

| Type of EDI Payment | Description |

| Direct EDI | A direct transfer between the paying and receiving bank, clearing immediately without the ACH network. |

| Check Conversion | Converts paper checks to electronic funds that post faster than physical checks. |

| Payroll EDI | Used by companies to deposit employee pay directly into their bank accounts. |

| File Transfer | Sending an electronic file containing payment details to initiate a funds transfer. |

| Purchase Order EDI | Allows suppliers to receive purchase orders electronically from buyers. |

| Accounts Payable EDI | Used for inbound supplier invoices and outbound remittance advices. |

Check conversion changes a paper check into an electronic draft that can post quicker. Payroll EDI is used by companies to deposit employee paychecks directly into their bank accounts. File transfer payments involve sending an electronic file containing payment details to initiate a funds transfer.

Difference Between Manual Payments and EDI

There are some key differences between making payments manually versus using EDI. With manual payments, businesses have to print, sign, and mail paper checks. This process is slower and comes with mailing delays.

NWEDI Payments Flex are all electronic so there is no physical paperwork or mailing involved. They also clear and deposit much faster than waiting for a check to arrive and post. Manual payments require manual data entry of invoices into a company’s accounting systems.

EDI vs. ACH vs. EFT

| Payment Method | Description |

| EDIT | Structured electronic data exchange between businesses |

| ACH | Electronic bank network for funds transfer between accounts |

| EFT | Electronic transfer of funds from one bank account to another |

While EDI, ACH, and EFT all facilitate electronic funds transfers, they have some key operational differences. EDI is a standard specifically for exchanging business documents and payment orders between companies.

ACH is the nationwide electronic funds transfer network that clears transactions through banks. EFT stands for electronic funds transfer and technically encompasses any transfer of money electronically, including EDI, ACH payments, and US Connect Charge transactions. So ACH and EFT are both broader terms that can include EDI as one method of electronic funds movement among businesses.

Benefits of EDI payments

There are numerous advantages for businesses that use EDI payments over traditional paper based methods. EDI saves on processing costs since it streamlines and automates payment workflows. It reduces payment times, allowing funds to clear and deposit faster into bank accounts.

| Benefit | Description |

| Saves Time | Funds transfer faster than paper checks. Electronic workflows streamline payment processing. |

| Reduces Errors | Automated digital formats replace manual data entry, reducing errors. |

| Lowers Costs | More efficient workflows lower processing expenses long term. |

| Improves Accounting | Integrating payment details directly into accounting systems simplifies reconciliation. |

| Audit Trails | Electronic records are securely stored, easy to search and reference for audits. |

| Early Settlement | Quicker clearing times enable early payment discounts. |

| Payment Visibility | Real time tracking provides transparency into funds movement. |

| Streamlines Trade | Especially helpful for industries with high trading volumes or compliance needs. |

| International Enablement | Facilitates cross border transactions between globally dispersed partners. |

| Inventory Management | Crucial for a just in time supply chain where timely payment prevents delays. |

Using EDI cuts down on errors that can happen with manual data entry and paperwork handling. EDI payments also enhance accounting reconciliation ease by directly interfacing payment details with business systems. The electronic records are much easier to archive, search and refer back to for auditing purposes.

When to Use EDI Payments

NWEDI Payments Flex are highly suitable for businesses that frequently transact with the same business partners. Industries that commonly rely on EDI include manufacturing, retail, healthcare and life sciences.

CompanieS with high volumes of invoices, purchase orders or other documentation with trading partners can greatly benefit from EDI’s automation. It streamlines recurring payment workflows. EDI is also valuable for time sensitive industries and those with just in time inventory where payment delays are costly.

Is an EDI Payment a Direct Deposit?

While anNWEDI Payments Flex transfers funds electronically like a direct deposit, there is an important difference. A direct deposit involves an individual signing up to have their paychecks or other regular receivables like government benefits deposited directly into their personal bank account.

An EDI payment is specifically a business to business funds transfer between companies based on invoices or other transactional documents. So an EDI payment automates B2B payments where a direct deposit automates deposits for individuals. Both achieve the goal of electronic funds movement.

Why Did I Get an EDI Payment?

There are a few common reasons why individuals may receive an unexpected EDI payment:

- Refund or Rebate: The payment could be an automated refund, rebate, or other money a company owes the person from a past transaction or purchase.

- Dividend or Interest: For example, a quarterly dividend payment from stock holdings or interest paid on a cash management account.

- Mistake: In rare cases, there could be an error where an EDI payment was accidentally issued to the wrong recipient due to a typo or data mismatch.

- Reimbursement: Repayment for approved business expenses on a corporate credit card or other work related costs.

- Side Job or Gig Work: Income from freelance, consulting or other independent contractor work billed through EDI.

The EDI payment details or documentation from the issuing company should provide more context about what transaction or obligation it fulfilled. Reaching out to that business can clarify why the specific funds were deposited.

What is NWEDI EDI Payments?

Swedish is an EDI payment network commonly used by businesses to pay electronic invoices. NWEDI EDI PYMNTS notifications indicate an EDI payment was made via the NWEDI network. Sometimes abbreviated as NWEDI these payments are listed on bank statements along with any associated flex charges or fees for using the NWEDI EDI payment system.

How do NWEDI Charges Show Up on your Bank Statement?

NWEDI charges typically appear on your statement within one to three business days of an EDI payment processing. The bank posting may say NWEDI EDI PYMNTS along with the payment amount and date. A separate line item will show any flex or convenience fee amount. These NWEDI charges will be listed in your account’s transaction section similar to other electronic payment details.

Preventing more NWEDI Charges

To avoid unexpected NWEDI charges companies using EDI should communicate payment arrangements to partners. Confirm which party is responsible for fees from their banking agreements. Review statements monthly for accuracy and contact NWEDI or your bank promptly about any unrecognized charges to prevent future errors. Proper EDI setup and ongoing monitoring help prevent mistaken charges.

Dealing With Unauthorized Charges

If unauthorized NWEDI charges do appear, there are steps to take:

- Contact your bank right away to dispute the transactions and request temporary credit/refunds while it’s investigated.

- File a report with the IC3 internet crime reporting site and FTC.

- If you sent any money in response to the scam, talk to your bank about recovering it with a fraud affidavit.

- Continue checking statements and credit reports for related suspicious activity.

- Avoid clicking links, sending info/payments unless absolutely sure of who you’re communicating with.

With quick action, many customers can work with their bank to resolve fraudulent EDI scam charges without further loss. Reporting helps authorities track and shut down criminal operations.

Discovering NWEDI Edi Payments Flex

Many companies may not realize small NWEDI edi payments flex charges are being applied until carefully reviewing bank statements. As these flex fees can range between $1 to $3 per EDI payment transaction they are easy to overlook. Accumulating several EDI documents monthly the amount of the charge can become significantly high. Businesses need to learn to identify NWEDI fee line items to avoid unexpected costs.

Regular bank statement audits help catch any incorrectly applied or multiple flex charges upfront before disputing with the bank. Flagging such recurring expenses also allows for negotiating better rate plans with EDI network providers like NWEDI.

NWEDI Edi Payments Flex vs Traditional Forms of Payment Through EDI

NWEDI EDI payments flex scams differ from legitimate EDI in some key ways. Traditional EDI is based on established communication and payment protocols used reciprocally between known business partners over time. NWEDI payments flex lack credentials and context they come unexpectedly from unknown sources via deceptive messages.

Legitimate EDI payments are traceable through audit trails within a company’s systems integrated with a partner’s. NWEDI flex scams try to operate outside of this transparency to disguise criminal activity and funds flows.

While EDI aims to facilitate B2B commerce, NWEDI flex scams misuse EDI terminology to trick and steal from unwitting consumers. Understanding the differences can help in avoiding and addressing fraudulent EDI schemes.

Implementation of Nwedi edi payments flex

Scammers implement NWEDI flex schemes using evolving social engineering tactics. They may register fake business entities and set up mock EDI systems to initiate fraudulent payments. Stolen financial records are used to populate fake remittance details.

Scam messages are carefully designed play on recipients’ trust in the security of authorized EDI funds transfers between known entities. As detection and prevention measures progress, criminals work to customize deception methods test what ensnares victims.

The Changing World of EDI Payment

As EDI payment technologies continue innovating with offerings like cross border payment platforms, real time settlement, and blockchain integration the secure use of EDI takes on new importance. While EDI streamlines B2B transactions, cybercriminals also study these trends for new avenues of using EDI terms to disguise fraud.

But greater transparency, accountability and collaboration enhances overall protection. Companies integrating EDI into platforms encourage partnership over anonymous transactions. Consumers educated on red flags avoid harm from deception.

Frequently Asked Questions

Final Thoughts

It is important to watch out for potential fraudulent charges labeled as What are NWEDI Payments Flex Charges on your Bank Statement? These scams try to disguise themselves using EDI payment terminology but lack the proper credentials and context of legitimate transactions between businesses. If any unauthorized charges matching this description appear be sure to contact your bank right away to address the issue and help put a stop to these types of financial crimes.