What Is The First Foundation In Personal Finance?

The first foundation in personal finance is developing effective money management skills. Building a budget and learning to track expenses are integral to taking control of one’s financial life. Gaining an understanding of income versus spending is key to avoiding future problems and working towards important goals. Developing good financial habits from the start by budgeting, learning and saving responsibly sets people up for long term financial stability and success.

Budgeting The Bedrock of Personal Finance

A budget is essential to getting control of your finances. It shows where your money comes from and where it goes each month. Creating a realistic budget allows you to track spending and focus funds on important items like housing food utilities and other necessities. With a budget you can ensure that you spend less than what comes in every month. Regular budget revisions keep your spending aligned with your earnings and goals.

Developing an accurate budget requires looking closely at income sources and keeping receipts for all expenses. Classify expenses as needs versus wants. Trim spending on wants to stay within your means. Evaluate bills for savings through lower rates. Making a budget part of your routine keeps spending and savings on track long term.

The Power of Saving and Investing

Saving means setting aside extra funds beyond what is needed in a budget for short and long term goals. It allows building emergency savings as a buffer for unexpected costs. Decide on a savings amount that works for your income and expenses each month. Automate transfers to make this effortless. Focus on paying yourself first by moving savings money right after getting paid.

Investing allows savings to grow faster than in a regular savings account. Retirement accounts let savings grow tax-deferred for decades. Even small amounts contribute to this nest egg over the long haul. Research options to find investments aligned with your risk tolerance and timeline. Compound growth and continued contributions help amass sizeable future savings.

Protecting Your Financial Future

Having insurance protects against unforeseen healthcare costs property damage liability and loss of income. Healthcare provides coverage for medical bills from illnesses or injuries. Renters or homeowners insurance replaces or repairs possessions or property if they’re damaged or stolen.

Life insurance pays money to chosen beneficiaries if the insured passes away. It ensures dependents are still provided for. Disability insurance replaces lost wages if illness or injury prevents working. An umbrella liability policy supplements auto and renters coverage if being sued for substantial damages. Review needs yearly as responsibilities change.

The Importance of Budgeting

Creating a budget is key to taking control of finances. A budget shows income and expenses each month. This identifies where money is really going. A budget promotes spending intentionally on needs while achieving goals.

Developing a realistic budget takes effort initially. Look at income sources and spending receipts to classify essential versus discretionary expenses. Make adjustments as needed to balance spending and saving each month. Sticking to a budget requires effort but gets easier over time and avoids wasting funds.

Tracking Your Income and Expenses

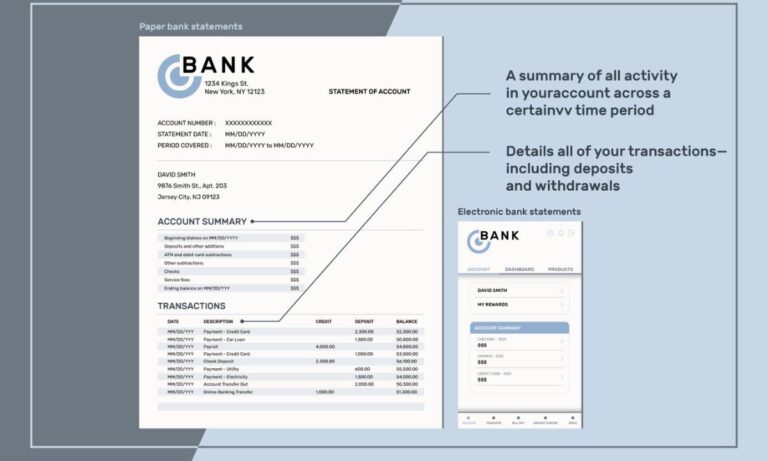

Tracking income is simple it comes from jobs self employment investments or other sources. Receipts and bank statements show spending over time in different categories like housing food transportation.

| Category | Amount ($) | Type (Income/Expense) |

| Salary | 3000 | Income |

| Rental Income | 500 | Income |

| Groceries | 300 | Expense |

| Rent/Mortgage | 1000 | Expense |

| Utilities | 150 | Expense |

| Transportation | 200 | Expense |

| Dining Out | 150 | Expense |

| Savings | 500 | Income (Savings) |

| Entertainment | 100 | Expense |

Classifying expenses as needs or wants is eye opening. It reveals where money could be better spent or saved instead of frivolous purchases. This knowledge helps plan changes to redirect funds toward goals.

Getting Control of Your Finances

A budget gives full visibility into where money comes from and goes each month. This control is empowering and prevents debting or draining savings unnecessarily. Sticking to a budget may feel limiting at first but allows focusing on what’s truly important. Willpower gets easier as budgets remove stress of overspending. Goals like savings become attainable through intentional spending within means.

The Power of Financial Awareness

Financial awareness comes from tracking income and expenses over time using a budget. As discussed in the article on trading in a car with existing financing Car Your Financing this process highlights spending habits and allows one to identify areas where adjustments could be made to spending or ways to increase income.

This awareness is liberating. It shows capacity to afford necessities and achieve savings goals through planned spending. No longer guessing about money its purposefulness releases worry and fuels progress.

Developing Accountability

Budgeting fosters accountability. It no longer allows blaming overspending on lack of oversight. Concrete income expense records are transparent and justify actions.

This accountability is motivating. It encourages discipline to follow the budget and proves dedication to priorities like savings through willfully balanced behavior. Accountability leads to pride in financial accomplishments.

Starting Financial Literacy Training

Education on basic money topics like earning spending saving and credit lays the groundwork for life. Even small kids can start learning core principles. Simple lessons using examples from daily life spark curiosity and questions. As children age, topics get more complex at their level to develop comfort discussing family finances. Early training instills comfort creating healthy habits.

Learning Basics Like Saving

Saving means setting aside extra money for either short or long term goals. It’s important to start saving regularly even in small consistent amounts. Savings help build emergency funds separate from regular expenses. Automating savings from each paycheck prevents relying on willpower later. With compound interest, small savings grow substantially over decades through regular contributions.

Understanding Credit Reports and Scores

Credit reports list account details, loan balances, payment histories, and inquiries. Additional details about personal financing can be found on articles discussing Listcarlwers as good payment behavior results in high credit scores that help procure loans at low rates.

Checking reports/scores yearly ensures correctness. Dispute errors to keep reports and scores accurate for accessing favorable credit terms in the future. Understand the impact of different financial actions on creditworthiness.

Investing in Your Financial Education

Education tools abound online and through libraries/parks. Ongoing learning prevents lasting ignorance that leads to poor choices and anxiety. Resources explain complex concepts simply. Diverse materials engage different learning styles and keep topics interesting. Commit to self paced study even if just 15 minutes daily adds up over time. Continual growth fosters comfort and competence managing money matters at any life stage.

Avoiding Costly Mistakes Through Knowledge

Ignorance can spark regrettable financial errors. Knowledge prevents wasted money and damaged credit from rash actions like unnecessary late fees impulse purchases using high interest debt or predatory lending schemes.

Education reveals ways to tackle money intelligently based on goals and capacity. It safeguards hard-earned resources and future possibilities through prudent choices begun early in life. Competence cultivates ease and confidence handling finances.

Building Strong Financial Habits for Life

Positive financial habits are key to long term security and peace of mind. Continual learning alongside regular budgeting, saving, debt management and record keeping reinforce wise practices.

Sustain focus even when overwhelmed by sticking to necessities. Financial routines adapt smoothly through life changes by maintaining control through awareness. Healthy habits make money matters manageable whatever comes.

FAQs

What is the most Important first Step in Personal Finance?

Creating a budget is widely considered the most crucial first step. A budget helps you understand your cash flow and ensure your expenses are covered by your income each month.

Why is building Savings Important?

Savings provides a financial safety net for unexpected expenses and helps you avoid going into debt. It also allows you to pursue future large purchases and goals.

When should I Start Learning about Credit Reports and Scores?

It’s best to start learning basics about credit reports and scores as early as possible, even as a young adult. Understanding how factors like on time payments and credit utilization impact your score helps you make smart choices to build credit history.

What Financial Topics should be Prioritized in Education?

Basic concepts like budgeting, saving, using credit responsibly and planning for common expenses like insurance should take priority in personal finance education. These skills help ensure day to day needs are met and provide a solid foundation.

How do Strong Financial Habits Build Long Term Success?

Ongoing habits like budgeting, saving consistently avoiding excessive debt and continually educating yourself financially compound over decades. These lead to financial flexibility to handle emergencies and pursue goals while enjoying financial security in different life stages.

Conclusion

Developing good financial habits and knowledge is essential for anyone looking to take control of their monetary situation. Budgeting learning and saving responsibly are what make up the first foundation in personal finance. With focus on continual education and practicing smart money management techniques people can feel confident maintaining solid financial footing no matter what changes come their way. Developing these skills early in life sets individuals up for long-term financial success.