What PNP Bill Payment Means on Your Bank Statement

Understanding PNP Bill Payment on your bank statement is crucial for financial clarity. PNP stands for Plug’n Pay a payment processing service often used by merchants. Charges under PNP typically signify transactions made through this platform. By recognizing these entries you gain insight into your spending habits and ensure accuracy in your financial records. It’s essential to review PNP transactions regularly to identify any discrepancies and maintain financial control.

What is PNP BILLPAYMENT?

PNP which stands for Plug’n Pay refers to a third-party payment processing service that allows customers to pay bills online through their bank account or debit/credit card. Payment processors like PNP act as an intermediary facilitating transactions between consumers merchants and financial institutions.

When a PNP bill payment is made, the resulting debit will appear on your statement with a description like PNP bill payment followed by the name of the merchant or payee that was paid. This notation helps distinguish online bill payments made through the PNP network from other types of transactions.

What Charges Can Appear Under Plug’n Pay?

There are many different types of recurring bills and subscription services that consumers commonly pay through PNP bill payment systems. Some of the most widespread uses include:

- Utility bills: Water electricity gas internet cable or phone services are routinely paid online through payment processors.

- Streaming services: Subscriptions for music movies TV shows audiobooks games with auto renewals.

- Memberships: Yearly fees for clubs organizations or online marketplaces.

- Services: Software as a service (SaaS) website hosting cloud storage etc.

- Rent or mortgages: Many property managers and lenders accept online bill payments.

How PNP Bill Payment Appear on your Bank Statement?

When a PNP bill payment transaction processes it will be clearly denoted on the customer’s banking statement. Typically the entry will include:

- Date of transaction: the day the payment was submitted and deducted.

- PNP BILLPAYMENT: Identifying the payment provider behind the transaction.

- Merchant name: The specific business or entity that was paid, if provided by PNP.

- Transaction amount: The dollar amount debited from the account.

For example, a typical PNP bill payment line item may read:

01/15 PNP-BILLPAYMENT ACME UTILITIES $120.55

This helps the statement reader easily recognize an online bill payment was made and to whom without needing supplementary paperwork. Proper formatting also prevents potential confusion with other types of posted debits.

Uses of Plug’n Pay (PNP)

As one of the largest online payment processors PNP’s network supports a massive volume and variety of transactions every day:

- More than 12 million US households use PNP for utility bill payments each month.

- Over 250 public utilities and municipal services accept PNP payments from residents.

- Countless online retailers SaaS vendors and subscription boxes integrate the PNP checkout.

- Major cable, phone and ISP providers partner with PNP for autopay enrollments.

- Thousands of property managers and landlords receive monthly rent via PNP.

- Millions of taxpayers utilize the system to pay state and local levies.

How to Identify Legitimate PNP Bill Payment Transactions?

With constant account monitoring and record keeping it’s possible to easily verify expected PNP bill payments:

- Check billing cycles: Due dates for utilities subscriptions loans should match posting periods.

- Review payment schedules: Note setups for automatic rent, auto insurance payments etc.

- Confirm recent activity: Log in to individual service portals for transaction histories.

- Match amounts: Current charges must equal invoiced or quoted totals from providers.

- Check payee details: The business name after PNP bill payment should be familiar.

- Spot discrepancies: Invoice numbers, addresses late fees can uncover errors or mix ups.

Tips for Avoiding Unnecessary PNP Bill Payment Charges

Practicing prudent payment habits is important for preventing unwanted PNP fees and dealing with issues smoothly:

- Use billing portals instead of auto scheduled repeats to pause services safely.

- Cancel cards compromised in data breaches to eliminate unauthorized recurring charges.

- Request paperless billing to avoid late fees from lost statements triggering duplicate payments.

- Set calendar reminders for whenever promo pricing expires to renegotiate rates or terminate.

- Vet all charities platforms or programs before supplying debit/credit details to third parties.

- Verify all payees in accounts match recognized businesses to spot and close fraudulent accounts.

- Check statements regularly for inaccuracies errors and payment discrepancies for fast dispute filing.

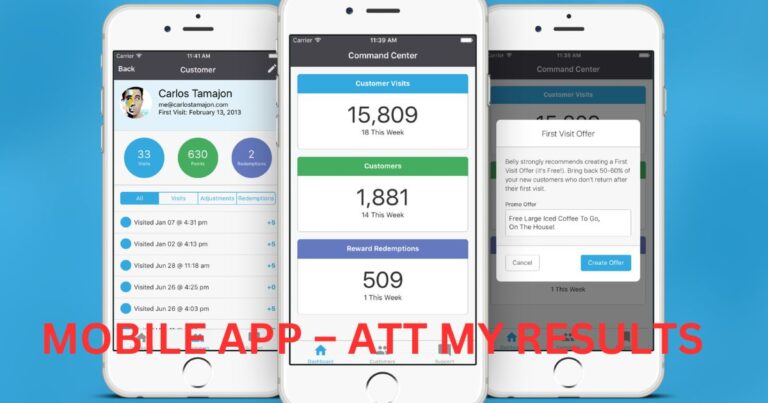

How PNP Bill Payment Works?

Here’s a brief overview of how a typical PNP bill payment process works:

- A bank customer signs up to have their qualifying bills paid through a third party PNP provider.

- The customer provides their bank account and billing details to the PNP service.

- On the designated payment date for each enrolled biller the PNP provider automatically deducts funds from the customer’s linked bank account.

- The payment amount is then distributed electronically by the PNP provider to the appropriate biller/merchant.

- The customer sees the PNP bill payment transaction post to their bank statement along with payment details.

- Received payments are then applied by the biller to the customer’s active service accounts.

Why you see a PNP Bill Payment Charge on Monthly Statement?

There are a few main reasons why a PNP bill payment charge may appear on your monthly bank statement:

- You or someone else has signed up your bank account for recurring automated bill pay services through a third party payment processor.

- A recurring payment you’ve previously authorized such as a subscription is being deducted from your account on its payment schedule.

- You may have accidentally enrolled in a service that automatically charges your payment method each month.

- In some cases fraudsters may access your accounts and enroll them in unauthorized subscription services.

- It’s important to carefully review all PNP bill payment charges each month and verify their legitimacy. Any unrecognized transactions should be investigated.

How to Identify Legitimate PNP BILL PAYMENT Transactions?

Here are some tips to help identify legitimate PNP Bill Payment transactions:

- Look for relevant payment details in the description like the merchant or provider paid

- Compare the amount to invoices or statements from those companies

- Check your billing history with the merchant to confirm payment schedules

- Search your email for enrollment confirmations from the PNP payment processor

- Login to your profile on the payment processor’s website

- Review past bank statements for recurring payments to that merchant

- Contact the payment processor and merchants directly to verify accounts

- Being able to trace a transaction to an authorized bill or recurring payment is a good sign it’s genuine. But still monitor closely for inaccuracies.

Tips for Avoiding Unnecessary PNP BILLPAYMENT Charges

To help prevent unnecessary PNP Bill Payment charges:

- Carefully review all bank statements each month

- Cancel any subscriptions or services no longer needed

- Use strong login credentials and enable two factor authentication

- Be wary of third party vendors with access to your financial accounts

- Avoid storing payment details on public/shared devices

- Regularly check your credit reports for new accounts

- Place alerts on your accounts for unusual activity

- Communicate directly with trusted merchants for payments

- Consider alternative bill payment options if possible

- Staying on top of your payment authorizations and activity can help curb unwanted charges.

Common Issues and Concerns

Some common problems and questions related to PNP Bill Payment include:

- Unrecognized charges: Seeing charges you didn’t authorize can be stressful. Carefully validate all PNP transactions.

- Incorrect amounts: Sometimes errors occur and the wrong payment total is deducted. Work with the merchant and processor to correct.

- Delayed payments: There may be short processing delays but prolonged issues could result in late fees. Escalate problems ASAP.

- Canceled services: Be sure to properly cancel recurring payments and subscriptions through approved channels to avoid further charges.

- Limited payment options: PNP typically only offers bank account debiting. Consider other choices like mail-in payments.

- Ongoing account access: Understand what personal data processors store and how long they may have ongoing withdrawal rights.

- Staying vigilant and addressing problems quickly can help reduce frustrations with PNP bill payment services.

What is a FPO Payment?

FPO, which stands For proper Ownership is a descriptor that may appear on statements instead of a specific merchant name for certain types of PNP bill payment transactions. This often occurs when the true originator relationship is between the customer and a third party biller rather than directly with the processor itself. So FPO simply indicates the correct recipient received payment, without needing to display sensitive account details of the underlying business.

Common Instances of FPO Payments

Some common examples where an FPO designation may show on PNP bill payments include:

- Payments to government tax authorities or licensing agencies

- HOA or property association management fee payments

- Online marketplace seller or website service subscriptions

- Donations processed through a charitable collection platform

- Crowdfunded pledges directed through a campaign processor

What does FPO stand for in Banking?

As explained above FPO stands For Proper Ownership in reference to bill payment transactions. It serves as a descriptor within the banking system to indicate that while the processing is facilitated through the payment utility listed (PNP) the true ownership of the funds is assigned elsewhere such as a government organization seller or fundraising recipient. The FPO designation protects privacy of underlying account details in these specialized payment situations.

Frequently Ask Question

Conclusion

PNP Bill Payment refers to automatic recurring payments made through third-party payment processors. While convenient for many routine bills it’s important consumers closely monitor all PNP charges on their bank statements each month.

Proactively verifying transactions and canceling unauthorized activity helps guard against unwanted fees and payment confusion down the road. With diligent review and quick issue escalation PNP services can work smoothly for managing monthly financial obligations.