What is the Hft Epay Charges on your Bank Statement?

Have you ever noticed cryptic charges labelled ‘HFT EPay’ on your bank statement? You’re not alone. This is a common charge that several banks levy for financial transactions done digitally. But what exactly does it mean? HFT stands for High value Funds Transfer and EPay refers to Electronic Payments. It is simply a fee charged by banks for transferring money via net banking, mobile apps or debit cards online.

Key Takeaways about Hft Epay charges

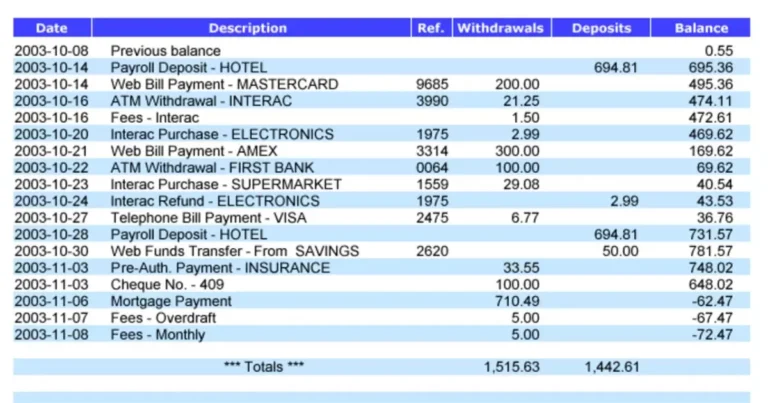

- Hft Epay charges is an electronic payment system that is used to send and receive funds. Many banks use this system to process electronic transfers.

- When you make or receive a payment through Hft Epay charges your bank will likely charge a small fee which will appear on your statement as an Hft Epay charge.

- Common Hft Epay charges charges include fees for outgoing wire transfers, incoming wire transfers bill pay transactions, and person to person payments made through services like PayPal or Venmo.

- Understanding what specific types of payments and transfers will incur Hft Epay charges can help you track these expenses on your statement each month.

- Small Hft Epay charges are normal and help cover the processing costs for your bank. But being aware of them prevents these fees from being a surprise on your monthly balance.

- Taking time to learn what the various Hft Epay charges represent is valuable for managing your accounts and budgeting your electronic payment needs.

Why do You get an HFT ePay Charge?

Many banks charge a small fee when customers make digital payments or transfer funds between accounts using online or mobile banking. This fee is known as an HFT ePay charges. It is levied to cover the costs incurred by banks for processing digital transactions. The charge amount is usually between Rs 20 to Rs 30 per transaction.

When you transfer money from your savings account to your credit card using net banking the bank will deduct a small HFT ePay charges. This applies for all types of financial transactions done digitally instead of through traditional modes like cash or cheque. The charge helps banks recover their infrastructure and technology expenses.

What to Do if You Receive an HFT ePay Charges?

If you notice an HFT ePay charges on your statement that you aren’t aware of, check all your online and mobile transactions carefully. Make sure the charge is legitimate and corresponds to a financial transaction actually made by you.

In case you find an incorrect or duplicate charge you can reach out to your bank via email phone or visiting a branch. Provide necessary details to help the bank identify the erroneous transaction. The bank will investigate and refund the amount if they determine a mistake was made on their end. Keep records of all communication with the bank in this process.

Is HFT ePay Charges a Scam or Fraud?

No HFT ePay charges are not a scam. These are normal banking fees charged by most banks for digital transactions. There is always a small risk of someone fraudulently accessing your bank account and making unauthorized transactions.

If you notice any unfamiliar transactions or charges on your statement it’s best to report it to your bank immediately. The sooner they are informed the better chances of recovering any lost funds through refunds or chargebacks. Don’t assume it’s a glitch without verifying with the bank. Stay alert and regularly monitor all account activity to spot suspicious activity.

What Is High-Frequency Trading (HFT)?

High-frequency trading refers to the use of sophisticated computer programs for transacting a large number of orders in fractions of a second. It involves using complex algorithms to analyze numerous market data and execute trades much faster than human traders.

HFT firms scan markets for opportunities to make very small profits on short-term price movements that may involve thousands or millions of trades in a single day. This type of automated trading relies on speed and requires colocation of computers within the stock exchange to minimize latency.

Understanding High-Frequency Trading (HFT)

To implement HFT strategies advanced computer systems use complex algorithms to process multiple sources of data at extremely fast speeds. This includes information on orders trades quotes news and financial filings. Within milliseconds the algorithm then identifies trading opportunities places automated buy and sell orders and cancels old orders.

Through this high speed trading process HFT firms aggressively enter and exit positions hoping to profit off of tiny temporary changes in stock prices. Their strategy focuses more on volume and turnover rather than holding positions for longer periods. Accuracy and speed are crucial for HFT to gain an edge over slower market participants.

Advantages and Disadvantages of HFT

| Advantages of HFT | Disadvantages of HFT |

| HFT provides liquidity to the market. It allows for many small trades to take place throughout the day. | HFT can exacerbate volatility in the market. Rapid buying and selling from algorithms may amplify price swings. |

| HFT helps to narrow the bid-ask spread. Computers are able to analyze pricing data and fill orders more efficiently. | Critics argue HFT prioritizes short-term profits over long-term investments. It may discourage traditional investors. |

| HFT increases trading volumes and turnover. The large number of orders placed helps stock prices reflect market information quickly. | Regulators worry HFT could potentially be disrupted or used to manipulate markets. Very fast automated trading introduces new types of risks. |

| HFT democratizes access to capital markets. Individual traders can now participate through lower-cost online brokers. | There are concerns HFT firms may have an “unfair advantage” over other market participants due to their faster technologies and co-location strategies. |

HFT provides much needed liquidity to the market by executing a huge number of trades every day. This improves transaction efficiency and narrows bid ask spreads. it can also increase volatility on some occasions.

While HFT has reduced trading costs for investors critics argue that it benefits mostly the large financial firms utilizing the strategy. Potential downsides include increased risks of certain algorithmic trades going wrong and triggering market disruptions or crashes. Regulators continue tweaking rules to curb any potential destabilizing effects.

How Does High-Frequency Trading Work?

To gain a speed advantage HFT platforms colocate computer servers in the same facilities as exchanges to shave off milliseconds from order transmission times. Their systems also use complex order management tools to plug directly into the exchanges’ matching engines via low latency connections.

Once set up the algorithms continuously collect and analyze gigantic streams of market data for patterns. Based on predefined models they rapidly buy and sell hold positions for extremely short durations and then offset their positions. Profitability rests on repeating this process thousands of times per second across several markets and liquidating positions before prices move against open trades.

Does the Cryptocurrency Market Use High Frequency Trading?

Yes high frequency trading is prevalent in cryptocurrency exchanges just as in traditional stock markets. With crypto markets being highly liquid and volatile there are ample opportunities for algorithms to exploit small temporary price deviations.

The crypto space has fewer regulations and less transparency than stock exchanges. This makes it challenging yet lucrative for HFT firms to deploy their strategies. Several rely on similar techniques like co location and low-latency connections while trading atop exchanges like Coinbase. HFT provides needed liquidity but critics point to risks of increased volatility in the emerging crypto sector too.

Who makes the ePay software?

EPay is a payment gateway and transaction processing platform developed by South Africa based Epay Europe (Pty) Ltd. Founded in 1995 Epay helps simplify digital payments for over 25,000 merchants across Europe and Africa.

Its software allows merchants of any size to securely accept card payments, recurring billing and ecommerce transactions online through a simple integration. Epay handles the complexities of real time authorizations fraud screening settlements and recurring payments on behalf of merchants via integrations with major card schemes.

Who uses ePay?

EPay sees widespread adoption globally across various industries for its secure and customizable payment solutions. Some major client categories include healthcare utilities education entertainment and ecommerce companies.

Frequently used by small businesses non profits and government agencies ePay also has enterprise level clients in sectors like insurance retail and telecommunications. Internationally recognized brands leverage its platforms to accept payments for subscriptions tickets bills and online purchases. The software powers payments on thousands of merchant websites and mobile applications.

Why do You get an HFT ePay Charges?

EPay offers transparent and flexible pricing structures for merchants of all sizes. Standard credit card processing rates begin at 1.75% plus a fixed transaction fee starting at INR 5. Debit card rates are lower at 1.25% + fee.

Recurring and subscription billing come with dedicated rates. Additional value-added services like AVS/CVV checks statement descriptors and refund/chargeback protection are optional. Gateway and plugin developers benefit from tailored APIs SDKs and webhooks along with support packages.

EPay works hard to keep rates competitive in different global markets. Special discounted rates are also available based on monthly volumes or for specific vertical industries. Their promise is to make digital payments seamless and cost effective for merchants via simple APIs and low cost of ownership.

FAQs

Conclusion

When you look at your bank statement you may see a charge listed from Hft Epay charges. This charge is likely from an electronic payment that was sent or received using the Hft Epay system. Understanding what these charges are for will help you track your expenses and payments more easily. In the end knowing what the Hft Epay charges on your bank statement are will help you manage your finances better over time.