What are the VIOC Charges on your Credit Card Statement or Bank Statement?

Have you ever looked at your credit card or bank statement and noticed a rate listed as VIOC? Were you not certain what it was supposed to be? VIOC charges, much like US Connect Charges fees, are hobby charges that are applied to your account when you do not pay your complete declaration of stability by the due date. This introduction aims to give an explanation of what VIOC prices are and how they impact your balance.

Key Takeaways about Vioc Charges

- VIoC stands for Variable Interest on Charges and refers to interest charged while you don’t repay your complete statement balance by the due date.

- VIOC charges expenses appear as a rate line object in your monthly credit score card or bank declaration. It lists the interest quantity owed for that duration.

- VIOC charges hobby is calculated each day based on your common daily balance from the preceding assertion. This divides your ending balance by using days in the billing cycle.

- VIOC charges most effective applies interest to remarkable balances carried over from the last statement no longer new purchases made within the current billing cycle.

- The best manner to keep away from VIOC charges is to pay your declaration stability in full each month before the due date. This guarantees you don’t have a rolling stability accruing hobby.

- Review statements intently each month and dispute any VIOC charges that seem erroneous. Act directly if you word unexpected or doubtlessly fraudulent transactions.

- Knowing what the VIOC charges represents and tracking statements often facilitates control interest fees and seize issues before they become larger troubles.

What is the VIOC Charge?

The VIoc fee is an hobby rate that appears to your credit card or financial institution announcement. It stands for Variable Interest On Charges and is applied while you don’t pay off your complete announcement stability with the aid of the due date. This consequences in hobby being charged on any remaining balance.

The VIoc price guarantees the financial institution earns hobby on balances which can be carried over from one announcement length to the next. It encourages customers to pay statements in complete every month to keep away from hobby fees. Only the tremendous portion of your balance could be charged interest no longer the entire balance.

How VIOC Charges Appear on Bank Statements?

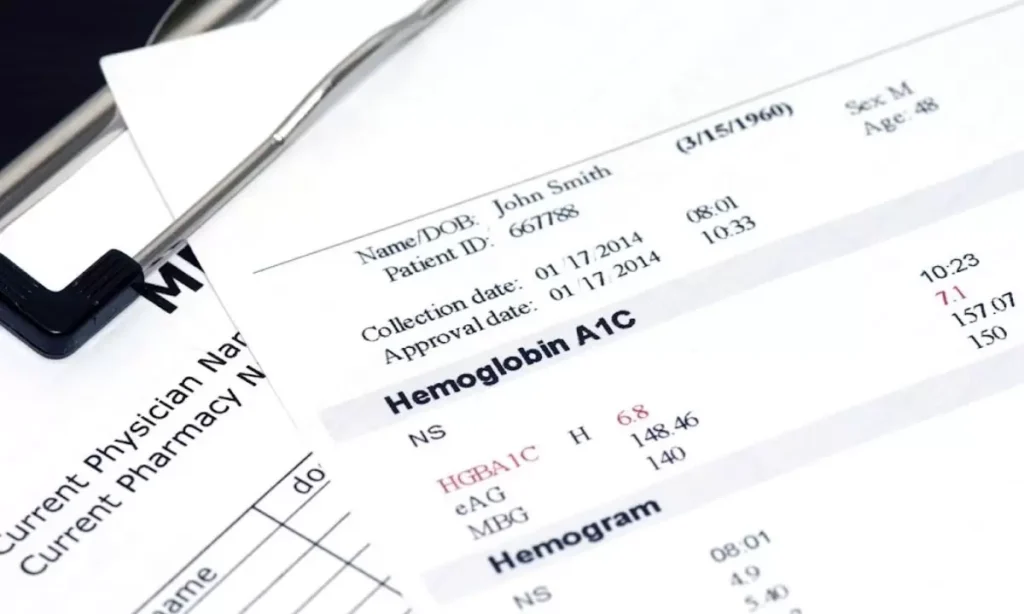

VIoc costs could be indexed to your statement with the abbreviation VIoc. It could have a date, reference number, and the quantity you’re being charged in interest. These costs, including Hft Epay Charges, are calculated based on your average daily balance from the declaration period.

The VIOC charges seems on monthly statements until the fantastic stability is paid off. Reviewing statements intently lets in you to check for accuracy on those hobby amounts. Contact your bank promptly if any VIoc expenses appear incorrect otherwise you want help information what the price represents.

dentifying Legitimate vs Fraudulent Charges

It’s important to scrutinize all fees listed to your statement inclusive of any VIoc charges. Compare dates and quantities to your purchase records. Legitimate VIOC charges will relate absolutely to a past balance you carried over.

Fraudulent charges may also have deceptive names references or dates that don’t in shape your information. Be on alert for any red flags and document anything suspicious in your financial institution right away. Following up promptly can help limit liability if your card variety has been compromised.

What is Jiffy Lube?

Jiffy Lube is a prime automotive provider chain placed in the course of the USA and Canada. They specialise in oil modifications and automobile upkeep services offered at low priced charges.

Jiffy Lube has over 2,000 carrier facilities making it a very recognizable merchant name. On bank statements the commercial enterprise call may be abbreviated in another way for listing expenses. So a Jiffy Lube purchase ought to display as just Jiffy or use every other brief form of the overall business call.

Why is it Called VIOC?

The VI in VIoc stands for Variable since the hobby charge implemented, known as the MSFX Charge, can alternate from month to month. It reflects that the fee is adjustable and not constant permanently.

The oc stands for On Charges as this charge specially costs interest on any balances that had been carried over from the preceding statement as opposed to paid in full. Together the Variable Interest On Charges acronym succinctly describes what the charge represents.

What Does the VIOC Charges Cover?

The VIOC charges most effective applies hobby on your average day by day balance from the past announcement duration. It does not fee interest on new purchases made inside the cutting edge billing cycle earlier than your charge due date.

Only ongoing balances from the preceding month that spilled over past the due date emerge as difficulty to VIOC charges interest. New transactions are nonetheless hobby unfastened till your subsequent declaration cuts. This allows customers recognize exactly what balances are factored into VIoc calculations each month.

How is the VIOC Charges Calculated?

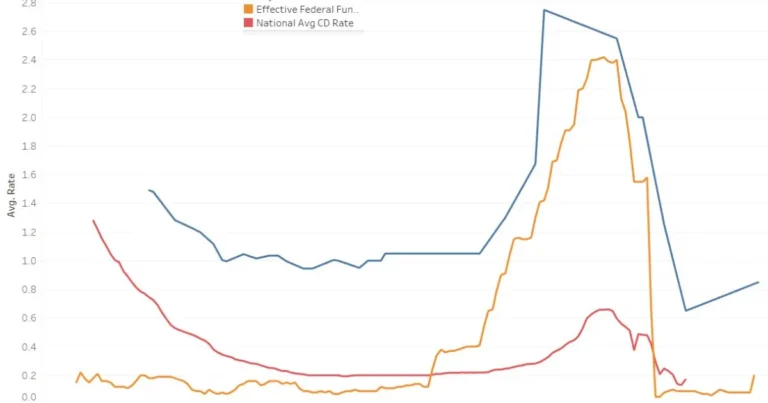

VIoc hobby fees are calculated each day based totally for your common every day stability from the prior announcement. The bank takes your ending stability adds in any new expenses or subscriptions then divides this by the range of days within the billing cycle.

This day by day stability is then increased with the aid of your hobby fee. Usually hobby rates variety among 12% to 30% depending on elements like your credit profile. Rates may also rise in case you’re late on bills. Understanding how VIOC charges is calculated helps check the accuracy of amounts on statements.

Can I Avoid the VIOC Charge?

Yes you can keep away from paying VIOC charges totally by means of paying your statement stability in full each month earlier than the due date. This guarantees you don’t bring any balance ahead to the next cycle.

Some banks provide a grace length in which you have until your payment due date to repay new purchases interest loose as nicely. But staying on top of due dates and paying down balances is the most effective way to be positive you don’t get charged VIoc interest for splendid amounts.

Merchant Names May be Different on Your Bill

Merchant names on bank statements aren’t constantly the entire keep or emblem name you see at checkout. Abbreviations DBA doing enterprise as names or simplified monikers may be used instead to save area.

For instance a rate from Walmart Supercenter ought to list the service provider as simply Walmart or use their internal processing name. Knowing this will assist recognize routine charges that appearance unusual at the start glance. Always healthy amounts and dates if a call does not appear quite proper.

Try Online Research

Conduct a web search for the service provider name at the side of phrases like credit card or fee processing. Sometimes this could display opportunity names or aliases used for card transactions.

Check Your Calendar

Review your personal calendar or notes from the assertion date range. Jot down any prices you do not forget making at some point of that time to jog your reminiscence.

Ask Anyone Who May Have Access to Your Card

Inform family buddies or personnel if they have a record of the usage of your card. Their purchase may additionally clearly have an unintuitive name at the declaration.

Contact the Merchant

Call the business enterprise without delay using statistics from your studies. Provide your call and last four digits of the cardboard to pick out the transaction.

How to Dispute a Transaction?

If you have exhausted all studies options and nonetheless do not understand a rate it’s time to dispute it. The process entails communication among you and both the service provider and your card company.

Contact the Retailer

Call the organization and try and resolve matters through providing more purchase information or documentation. Most will voluntarily trouble a credit score if it is a legitimate mistake.

Contact Your Card Provider

If the service provider cannot help report a dispute via your card’s billing inquiry system. Submit any proof you have like snap shots or invoices. Your financial institution will inspect to your behalf.

Contact Your Card Provider

The bank will evaluate information from each sides and make a willpower. You can also acquire a brief credit score at the same time as the dispute is pending. In most fraud cases you pay nothing. But act quick for the first class decision.

Track Your Expenses

Use a budgeting app spreadsheet or notebook to report all purchases which include small ordinary fees like subscriptions. This makes reviewing statements easy via matching to your data.

Take Steps to Protect Your Card

Sign up for purchase indicators best share your range securely in person or over the cellphone screen statements intently and record something questionable to your financial institution as a precaution.

Review Your Statement Regularly

Set aside time every month to fully look at the fee line by means of line. Having a device to triple take a look at prices prevents issues from piling up if an blunders slips thru to start with. Staying informed is fundamental to seizing troubles directly.

Find fees for Google products

Google makes use of plenty of service provider names for billing like Google YouTube or Google Googlestore. Check reference numbers cautiously as they every now and then include extra information to suggest the precise product bought such as YouTube Premium or Google Play.

Pending transactions

Authorizations located on a card for an eventual fee are indexed as pending until the store submits the real transaction amount. These don’t constitute real charges but. Only accredited quantities effect balances and incur hobby costs.

Find costs for non Google merchandise

Sometimes traders that be given Google Pay might also display up with out clean naming. Try looking the quantity and date variety online to become aware of the agency. As with any unusual fee contact the service provider at once along with your name and last 4 digits for help matching to a buy.

What is this fee on my credit card declaration?

This assertion consists of a rate indexed as Quarterly Fees. Many cards price an annual or month to month maintenance price that is divided into equal installments throughout statements. Review the phrases & situations or call your company to verify details of any regular fees in your account.

What forms of charges are protected on this purchaser’s credit card statement for the month?

The assertion indicates an hobby rate annual charge installment and overdue price. The interest is a VIOC rate for wearing a balance. The annual price is a percentage of the every year quantity. The overdue rate enforces on time bills by means of charging for lacking the due date. All fees are ordinary for credit score cards.

FAQ‘s

Conclusion

It is crucial for clients to cautiously evaluate all fees on their credit card or bank declaration every month together with what are the VIOC charges to your credit card assertion or financial institution announcement? Checking for unknown or suspicious charges enables make sure you’re handiest deciding to buy what you truly owe. Understanding commonplace billing phrases like VIOC charges empowers clients to better control their budget and deal with any issues in a well timed manner.