Gold Price Fintechzoom: Understanding The Current Trends

Gold is a precious commodity that holds significant value as an investment and store of wealth. With the economy facing uncertainty many investors closely monitor Gold Price Fintechzoom for trends and insights. This article from Fintechzoom explores the latest developments impacting the gold market.

It analyzes factors influencing gold price movements and highlights important patterns in today’s economic conditions to help readers gain a deeper understanding of gold’s role in the present financial landscape.

How has the Gold Price Shifted Recently?

In the past year gold prices have risen significantly. The price of gold climbed steadily throughout 2021 as economies reopened following pandemic lockdowns. Several factors contributed to rising demand including inflation concerns and ongoing geopolitical tensions. As a safe haven asset gold attracts more investors during times of economic and political uncertainty.

In early 2022 prices fluctuated more sharply. Fears of rising interest rates caused gold to dip briefly. The Russian invasion of Ukraine boosted haven demand again. Renewed inflation worries related to surging energy costs also supported the metal. Now despite market volatility, gold remains well above pre-pandemic levels.

What Role Does Fintechzoom Play in Monitoring Gold Prices?

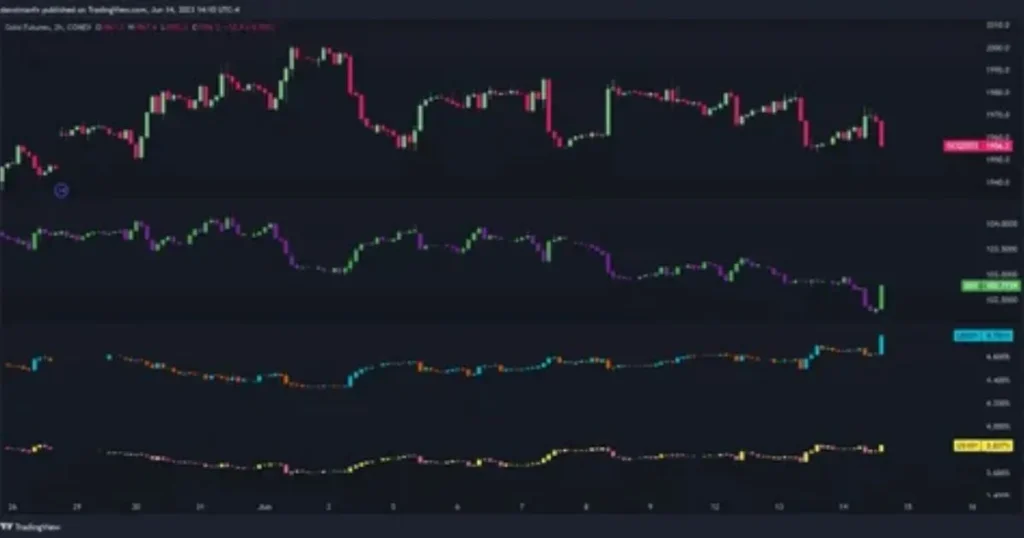

Fintechzoom is a leading provider of real time commodity prices including gold. The company utilizes powerful tracking technology to monitor gold trading around the clock. This allows Fintechzoom to deliver up to the second spot price quotes for gold to investors globally.

Through its website and mobile apps Fintechzoom streams live gold data direct from major exchanges. Charts, news and analytics give investors dynamic insights into market movements and influencing factors. Customizable alerts also notify users of any sudden price changes. With round the clock coverage Fintechzoom ensures nobody is left in the dark about gold’s current value.

Why is it Essential for Investors to have Real-time Updates on Gold Prices?

Keeping up with real time gold price fluctuations is vital for investors. Gold markets are highly dynamic influenced by macro factors as well as technical trading. Prices can move rapidly based on major announcements or geopolitical events. Without live data investors might lose opportunities or face risks from undue delays. Up to date spot rates allow for well-timed purchase and sale decisions.

Precise pricing also helps manage downside exposure. Gold holds aren’t immune to volatility. Real-time views of movement assist with risk management tactics. Whether topping up or trimming holdings, investors need current values to act strategically.

How can Real Time Gold Price Updates Benefit Investors?

Access to live gold rates presents several advantages. It enables investors to catch intraday fluctuations and capitalize on short term trades. With streaming data opportunities for small gains become feasible even for casual traders. Real time views also aid long term strategy. Investors can assess gold’s relative strength versus economic indicators or rival safe havens.

Live pricing helps track broader market influences on gold. Geopolitical tensions or interest rate statements tend to spur instant reactions. Sources like Client Pulse that provide real time updates further allow for timely rebalancing to target exposure levels. Knowing effects as they unfold from such services facilitates adjustments in allocation weightings.

What Role Does Fintechzoom Play in Monitoring Gold Prices?

Fintechzoom offers real-time gold price monitoring through various channels. For example visitors can access a comprehensive live dashboard on Fintechzoom’s website. Here the latest spot rate is displayed prominently alongside dynamic charts and headlines. Users can also download mobile apps for on the go access. These present gold values analytics and customized alert settings.

Behind the scenes, Fintechzoom connects directly to major bullion banks and exchanges. Its automated data feeds import price quotes continuously from active gold trading venues worldwide. Sophisticated processingthen distributes this real time market data to users reliably. As a leader in commodity data delivery, Fintechzoom ensures its gold coverage remains fastest and most accurate.

Timely Decision Making

Real time gold price data from Fintechzoom allows for timely decisions. Up to date market information means investors can react to changing conditions. With streaming quotes opportunities from short term price fluctuations are visible. Whether deciding to buy sell or hold investors are equipped to act based on current market factors. Precise spot rates empower well timed trading when little shifts occur.

Interactive tools on their Personal Finance section identify imbalances from price movements. This guides ensuring exposures meet intended objectives over various cycles. Staying informed about price updates through their Personal Finance content helps in timely rebalancing for goal achievement.

Risk Management in Gold Price Fintechzoom Investment

Access to real time gold quotes aids risk management of holdings. Streaming data presents an instant view of volatility. Customizable alerts notify of abrupt moves beyond set levels. This allows taking prompt action on unwanted downside. Live pricing also helps control portfolio drawdowns. Detecting forming downtrends enables timely steps like reducing quantities.

Fintechzoom’s analytics provide vital context behind numbers. Historical data and news updates reveal what’s influencing current gold trading. This additional color supports careful assessment of emerging risks against rationales. It helps distinguish normal fluctuations from potential long-term shifts requiring strategic response.

Enhanced Profitability

Real-time gold updates enhance profitability potential. Spotting short lived intraday changes becomes possible for gains. With streaming access even occasional traders can capitalize on tiny movements. Live pricing also deepens longer term fundamental analysis. Charts alongside flowing factors help identify well timed entry points near support or resistance. Selecting optimal purchase costs increases returns.

Continuous monitoring through Fintechzoom maintains focus on value against other stores. This powers rebalancing at highs to lock profits. By seizing opportunities revealed through constant monitoring, compounded gains build over seasonal cycles. Increased insights maximize returns on investment.

Improved Portfolio Performance

Constant streaming gold rates boost portfolio results. Up to the date correlation data against broader markets like equities or Merchant Cash supports dynamic hedging. Live pricing enables swift adjustments as these relationships change. This strengthens the protective aspects of precious metals holdings during unpredictable economic environments.

Interactive tools also aid strategic allocation decisions between gold and other safe havens. Comparing relative strengths highlights where similar needs are best served at a given time. Ongoing rebalancing then locks benefits. Overall performance thereby improves through fine tuned diversification supporting aims. Real time rates power enhanced decision-making supporting long term objectives.

Timely Decision Making

Access to real time gold prices allows timely decisions. Up to date market data means acting on changing scenarios. With streaming quotes profiting from short fluctuations is possible. Deciding to purchase sell or hold relies on current influences. Precise spot rates permit well timed calls on minor shifts.

Live pricing also facilitates regular rebalancing. Constant monitoring through Fintechzoom shows if allocations stay aligned. Interactive charts identify weight divergences from movements. This guides re targeting exposures through cycles.

How Investors can Access Real Time Gold Price Updates?

Investors can access real time gold price updates in several ways. Fintechzoom provides live gold rates on its website. The website shows the current spot price and has interactive charts. These charts update automatically as the price changes. Investors do not need to refresh the page to see the latest price.

Fintechzoom also has mobile apps for iOS and Android. The apps display real time gold prices on the home screen. Prices on the apps change instantly without any loading. Investors can watch gold price movements even when not online. The apps send alerts if the price crosses certain thresholds.

Online Platforms

Investors use online platforms for gold prices. Websites show current spot rates. Prices automatically update without refreshing. Charts display price changes over time. Websites have custom alerts for price moves. Investors select the price change amount. This alerts them on smartphones about price changes.

Mobile apps also offer real time gold rates. Apps show prices on home screen. Rates instantly change without loading. Investors watch prices anywhere with smartphones. Apps have alerts like websites. Alerts notify investors of pre set price level crosses.

Trading Platforms

Brokerage platforms trade gold. They give latest price before orders. Charts during trading show price effect on orders. After trades investors see trade price versus current price. Some charge trading commissions. Others offer free trades for signing up. Minimum account balances apply usually.

Some allow gradual gold ownership. New investors buy small dollar amounts regularly. This steadily builds holdings over time. Without large cash upfront it eases entry into gold markets. Funds stay invested rather than waiting for right price timing.

News Sources

Financial news websites report on gold. Websites constantly update gold spot price. Articles explain price moves and major event impacts. Videos interview experts for outlook. Some sites live stream commodities market programing.

Mobile apps also provide gold news. Push notifications alert breaking reports. Investors tap for full stories on the go. Links take users to related news. Occasional newsletters round up weekly major developments.

What are Real Time Gold Price Updates?

Real time gold price updates provide current gold rates. Websites and apps show the latest price of gold. This price constantly changes during the day. Updates reflect gold trades on exchanges from around the world. Prices change when new trades occur. With real time updates investors see these price changes immediately.

The Role of Data Aggregators

Data aggregators collect gold price data. They get prices directly from exchanges. Exchanges include COMEX and Shanghai Gold Exchange. Aggregators take this data and distribute it. Websites like Fintechzoom get gold prices from aggregators. This allows Fintechzoom to offer real time updates to investors. The data is streaming so prices change continuously on screens.

How are Prices Calculated?

Gold trades on exchanges determine prices. When a trader buys gold that trade price sets the market rate. As more trades occur the price fluctuates. It can rise or fall based on supply and demand. Sometimes big trades impact the price bigger. Other factors like news and inflation also move gold up or down. The constant trading forms fair gold price levels.

Displaying the Updates

Websites and apps present gold rates simply. Numbers show the current price in dollars per ounce. Charts track price movement over chosen time frames. Some include related data points too. Everything changes live without reloading. Updated figures mean seeing price impacts immediately as they happen worldwide.

Benefits of Real Time Updates

Real-time access helps trading decisions. Knowing prices lets buying at lows and selling highs. It spots volatility for short term moves. Constant monitoring maintains portfolio balance long term too. Live updates on all devices keep investors informed anywhere anytime without delay. Overall real time rates improve market understanding and opportunity taking.

How do you Subscribe to Gold Price Fintechzoom Updates in Real Time?

Subscribing is easy. Visit fintechzoom.com and sign up with email. This takes under a minute. Then select alert preferences like price changes. Pick thresholds like $5 moves up or down. Next choose alert delivery emails or app alerts. Mobile apps have free alerts too through push notifications. Following fintechzoom then provides real time gold rates at selected alert levels right to user devices. No delivery delay means always being in the know about quick price changes.

Staying informed aids wise investing decisions. Real-time updates support tasks from trades to risk management. Fintechzoom’s live gold coverage supplies constant transparency for smooth decision making in fast markets. Subscribing brings this direct to investors easily.

FAQs

What are Some of the Top Factors Currently Influencing Gold Prices?

Some key factors covered in the article include inflation levels, currency exchange rates global economic growth forecasts geopolitical uncertainty central bank policies, and investment demand.

How can Understanding Trends help Investors?

Being aware of the trends discussed can help investors make better informed choices about whether to buy sell or hold gold during different market conditions.

What does the Article say About Inflation’s Impact on Gold?

It explains that gold often benefits during periods of higher inflation as investors view it as a stable hedge against rising consumer prices.

Which Currencies does the Article Discuss in Relation to Gold Prices?

The US dollar and Euro prices are closely monitored since gold benchmarks are denominated in those currencies. Gold may rise when those currencies weaken.

What level of Detail is Provided on each Trend Discuss?

The article offers a good overview of each trend and how it specifically drives gold prices up or down to help readers understand the current market environment.

Conclusion

The gold market remains complex with various factors influencing price movements on a daily basis. By keeping up with current trends through sources like Gold Price Fintechzoom: Understanding The Current Trends investors can gain valuable insights to help navigate fluctuating times in the gold market. Staying informed of developments can assist investors in deciding when might be the right time for opportunities to buy gold at cheaper prices or sell when prices are higher.