FintechZoom Ge Stock: The Comprehensive Guide

GE is one of the largest and most established companies in the world but its stock price has taken a beating in recent years. Once a safe blue chip holding GE is now considered more of a turnaround play. This could make it an intriguing opportunity for investors.

Under a new CEO the company has been streamlining its business and paying down debt. This comprehensive guide will explore the past performance of Fintechzoom Ge Stock analyze its operations and market segments and uncover insights from experts on whether a recovery may be underway.

Understanding the Basics of GE Stock

GE stock refers to shares of General Electric Company. GE makes industrial equipment like aircraft engines and power turbines. It also provides aviation healthcare and renewable energy services globally. Investors buy GE stock to share in the company’s profits and growth over time. Staying informed on key metrics helps understand investment risks and potential returns.

Key Financial Metrics and Their Significance

Financial metrics provide a helpful snapshot of a company’s performance. Revenue indicates yearly sales across all business units. Net income shows profit left after all expenses. Investors analyze growth rates in revenue and earnings to gauge business expansion over time. Comparing metrics year over year provides critical performance indicators.

Market Capitalization

Market cap represents the total value assigned to a company by investors. It equals current stock price times number of company shares outstanding. A high market cap signals greater investor confidence and financial strength but also sizeable company size. GE typically ranks among the top 10 largest publicly traded U.S firms by market cap.

Price to Earnings (P/E) Ratio

The P/E ratio indicates whether a stock is reasonably priced relative to earnings. It shows stock price divided by earnings per share. A lower P/E suggests the stock may be undervalued. Ratio alone does not indicate a good buy. P/E should be considered alongside other factors like growth prospects and dividend yie.

Dividend Yield

Dividend yield measures the percentage return from a stock’s annual dividend payments relative to current price. It assesses cash received from ownership. Though a high yield implies sizable cash flow to shareholders it may also signal future profit and payout risks for careful investigation. GE frequently offers about 3-4% here.

Recent Performance of GE Stock

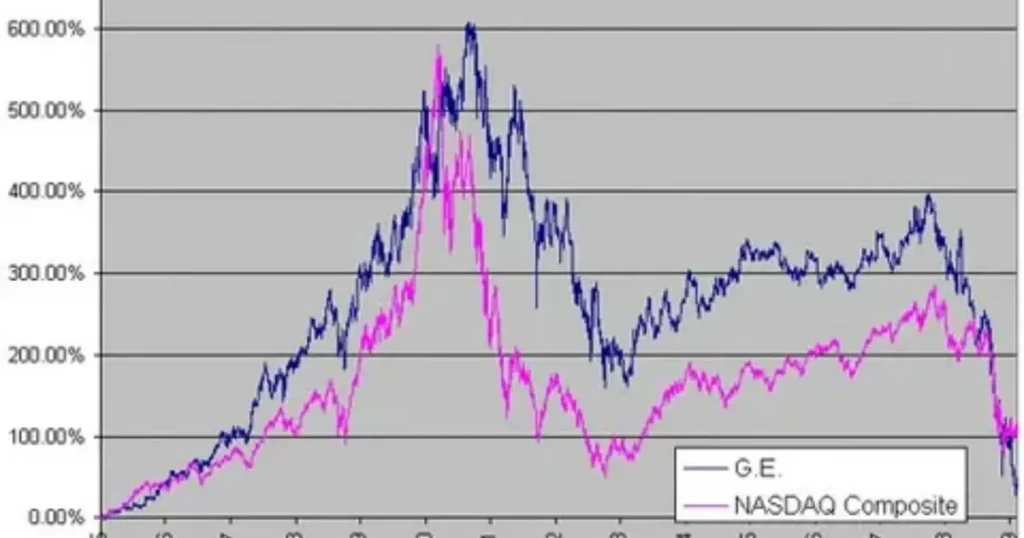

GE stock price declined in recent years. In 2016, shares traded near $30 but fell to $13 by 2018. Losses in GE’s power business caused problems. New CEO Larry Culp worked to improve performance since 2018. Under his leadership GE sold assets and cut costs to repay debt. By 2021 the stock rebounded to $13 from pandemic lows.

Overview of Stock Trends

GE stock trends provide insights for investors. In good economic times, shares rose with business expansion. But downturns hurt as customers delayed purchases. Unexpected losses led to sell offs. The stock also reacted to leadership changes and strategic moves. Analyzing multi year trends aids understanding risks and potential.

Analysis of Price Fluctuations

GE share price dropped on poor quarterly earnings. Exiting 2020, shares slipped when a cash crunch arose. Positive economic signs boosted the recovery throughout 2021. Yet price dipped on new virus variant threats. Geopolitical unrest also sparked volatility. Identifying catalysts helps foresee bumps.

Significant Milestones

In 2018 a new CEO aimed to strengthen operations. GE sold biopharma and distributed power assets to cut debt. In 2021 an aviation unit spin-off created three independent companies. This simplified structure focused each on their field. Separating non-core businesses pared risks and unlocked value over time.

Recent Performance of GE Stock

GE stock value declined in recent years. In 2016, shares traded near $30 but fell to $13 by 2018. Losses in GE’s power business caused problems. New CEO Larry Culp worked to improve performance since 2018. Under his leadership, GE sold assets and cut costs to repay debt. By 2021 the stock rebounded to $13 from pandemic lows.

Overview of Stock Trends

Examining GE stock trends provides investor insights. In good economies, shares rose with expansion. However, downturns hurt as clients delayed buys. Unexpected losses resulted in sell offs. The stock also reacted to leadership switches and strategic moves. Long term trend analysis aids understanding risks and potential.

Analysis of Price Fluctuations

GE share price dropped on poor quarterly profits. Exiting 2020 shares slipped when a cash crunch arose. Positive economic signs boosted recovery throughout 2021. Yet price dipped on new virus variant threats. Geopolitical unrest also sparked volatility. Identifying triggers helps foresee bumps.

Significant Milestones

In 2018 a new CEO aimed to strengthen operations. GE sold biopharma and distributed power assets to cut debt. In 2021 an aviation unit spin off made three independent companies. This simplified structure focused each on their field. Separating non core businesses reduced risks and unlocked value with time.

Detailed Analysis of GE’s Market Segments

GE operates diverse business segments. Its portfolio spans aviation, healthcare, renewable energy and more. Each segment focuses on specific industries and markets globally. Understanding these segments provides insights for investors.

Aviation Sector

GE’s aviation segment supplies commercial and military aircraft engines. It designs and produces engines for Boeing and Airbus planes. GE also services engines to keep aircraft flying. As airline demand grows aviation drives significant sales and profits for GE.

Healthcare Technology

GE Healthcare offers medical imaging technology bio pharma tools and clinical care solutions. This includes ultrasound CT scans healthcare IT platforms and more. Healthcare markets stay important as populations age worldwide.

Energy and Renewable Resources

Power serves utilities and energy industries. Wind turbines and hydropower aid renewable sources. Oil and gas operations target energy markets too. Clean energy shifting boosts this segment’s newer gear like solar panels long-term.

Diverse Portfolio Driving Growth

GE operates across diverse global markets. Each segment specializes in distinct industries. Aviation and healthcare typically post steady sales. Growth prospects reinforce prudent portfolio balance. Emerging clean technologies portend renewable energy expansion. Overall diverse focus counters volatility to fuel revenues.

Integration and Synergies

GE achieved strength through acquisitions over decades. Combined operations realize cost-saving synergies from shared services and logistics. Cross selling opportunities also emerge. segments collaborate like healthcare tools enhancing aircraft safety. Such integration drives innovation and efficiencies company-wide.

Step by Step Guide: How to Analyze GE Stock on Fintechzoom?

Fintechzoom provides tools to research GE stock. Follow these steps to efficiently analyze key investment factors and make informed decisions.

Step 1: Accessing the Site

Go to fintechzoom.com and search for GE. This pulls up the stock snapshot page. Here basic data like price, daily changes appear up top.

Step 2: Analyzing Stock Metrics

Study charts showing price history and volume over days to years. Check ratios like P/E to compare GE to industry. Review financials for revenue, earnings, debts and more.

Step 3: Exploring Financial News and Analysis

Read recent news articles for updates. Filter by source and date. Watch videos of CEO interviews for strategy insights. Analyze Wall Street reports and forecast data.

Leveraging Tools for Deeper Insight

Use screener to filter stocks. Compare GE to segments or indexes. Set price or earnings alerts. Chart custom studies including moving averages. Simulate impact of Holdings changes. Tools support informed investing.

Investment Strategies: When to Buy or Sell GE Stock?

Knowing when to buy low and sell high impacts returns. Timing market fluctuations properly takes discipline and research. Analyzing GE metrics guides strategic transactions.

Timing the Market for Optimal Results

Buying dips offers entry points. GE often slips short term on sector weakness. Yet quality stocks regain value long run. Selling rallies locks profits from bouncebacks. Patience prevents acting on every short term move.

Buying Strategies

Add on price pullbacks if fundamentals stay sound. Average down cautiously if believing in long term strengths. Scale in gradually over withdrawals instead of lump sums. Reinvest dividends to compound holdings. Buy more on structural changes extending growth runway.

Selling Strategies

Trim positions that exceed target allocation. Lessen concentration risks. Pare when valuation outgrows potential or key catalysts fade. Sell entirely if business risks surface long term. Consider tax impact of realized capital gains.

Utilizing Fintechzoom Tools for Strategic Decisions

Track custom charts and alerts. Assess if value aligns indicators like moving averages. Monitor newsflow for strategic milestones. Use portfolio simulators testing what if changes. Analyze comparisons to spot disparities signaling action. Inform choices with ongoing examination.

Expert Opinions And Future Outlook

Analyst viewpoints aid understanding GE’s direction and potential. Interpreting predictions requires vetting sources’ accuracy records.

Insights from Market Analysts

Analyst firms rate stocks and adjust targets quarterly. Checking varied reports gauges consensus sentiments. Comparing recommendations over time signals opinion shifts informing watchlists.

Analysts Views on GE’s Strategic Direction

Spinoffs streamlined focus on core aviation, healthcare. Divestments deleveraged balance sheet. Experts debate if cost cuts sufficiently repaired fundamentals. Optimists see leaner GE harnessing cash flows. Pessimists view debt laden risks awaiting next downturn.

Future Market Trends

Aviation demand depends on global growth, travel trends. Healthcare expands with aging demographics. Renewable energy adoption drives long-term opportunities. Government initiatives spur clean technologies. Economic cycles impact capital spending cyclically across segments.

Utilizing Fintechzoom for Forward Looking Insight

Monitor major analyst price estimations. Read interviews explaining strategies. Compare notes on competitive landscapes and policy impacts. Sign up for newsletters rounding professional perspectives. Integrate expert viewpoints refining personal thesis on GE’s long-term potential.

Expert Opinions and Future Outlook

Analyst perspectives aid understanding GE’s direction and possible performance. Evaluating sources’ past accuracy helps interpret predictions.

Insights from Market Analysts

Research firms rate stocks and adjust targets each quarter. Checking various reports measures consensus sentiment. Tracking recommendation changes over time signals evolving viewpoints to note.

Analysts Views on GE’s Strategic Direction

Spinoffs streamlined focus. Divestments paid down debt. Experts debate if cuts sufficiently repaired fundamentals. Optimists expect leaner GE harnessing cash flows. Pessimists see debt-laden risks awaiting recessions.

Future Market Trends

Aviation demand relies on global expansion travel patterns. Healthcare grows with aging populations. Renewable energy adoption drives long term opportunities. Government initiatives push clean technologies. Economic cycles impact capital spending cyclically across segments.

Utilizing Fintechzoom for Forward Looking Insights

Follow major analyst price targets. Read interviews explaining strategies. Contrast landscape and policy impact notes. Sign up for newsletters rounding views. Integrate expert perspectives refining personal GE long term potential thesis.

FAQs

What is GE and what Industries or Sectors does it Operate in?

GE is General Electric a large American multinational conglomerate. It operates in sectors like aviation renewable energy power healthcare and capital.

What key Factors does the Guide Analyze Regarding GE Stock?

It covers GE’s financial performance, management changes debt issues spin offs industry trends and how these influence the stock’s price movement.

How has GE’s Stock Price Performed in Recent Years?

The guide notes GE’s stock plunged over 70% from 2018-2020 due to debt problems and underperformance. It has stabilized since but remains below pre 2018 highs.

What Predictions does it make about GE’s Future Stock Potential?

It suggests the stock could rise as it continues simplifying operations through spin offs but performance will depend on individual business recoveries post pandemic.

Does it Provide any Investing Considerations or Recommendations?

Yes it offers insights into both bullish and bearish factors for investors to weigh when deciding whether to buy short or avoid GE stock.

Conclusion

Fintechzoom Ge Stock: The Comprehensive Guide provides a thorough analysis of the many aspects influencing GE’s stock price. By understanding the company’s ongoing transformation efforts and challenges highlighted in the guide investors can make educated assessments of where the share value may be headed. Thoroughly researching sources like this can lead to well-informed investment choices regarding a large conglomerate like GE.