When Can This Credit Card Company Adjust Your Apr?

Credit card interest rates, also known as Annual Percentage Rates (APRs) can have a significant impact on your monthly payments and the overall cost of carrying balances. Understanding how and when your credit card issuer can adjust your APR is important for effectively managing your finances in different situations.

Why Try to Get Your Rate Lowered?

A lower credit card APR can save you money if you regularly carry balances. Even a small reduction in your interest rate, say from 20% to 18%, can significantly decrease the total interest tacked onto your balances over time. If you might have periods of higher balances in the future, it’s worthwhile to ask your credit card company about getting a lower rate now.

Understanding Your Credit Card Company

Each credit card issuer has their own policies for adjusting APRs. Most will increase rates for factors like late payments or exceeding your credit limit. But they may also lower rates to retain customers, especially if you have a long positive history with good on-time payments. Communicating openly with your issuer will help you understand their practices.

How to Negotiate a Lower APR?

When requesting a lower interest rate from your credit card company, focus on the following steps:

Assess Your Situation

Review your on-time payment history, current balances, credit limit, credit score and overall relationship length with the issuer. This will provide context.

Ask the Right Person

Contacting the issuer’s retention department gives you the best odds of success, as their goal is keeping customers happy. Explain your situation clearly.

What to do After a Decision?

Even if denied, politely ask what you could do to qualify for a better rate in the future. Maintain good habits like paying on time going forward. A subsequent call may have a different result with continued goodwill and improved credit metrics.

The Bottom Line

Checking your APR regularly is important for tracking interest costs and seeing if better rates are available. With open communication and a positive credit history, you have a chance at getting expenses reduced. It’s worth a friendly inquiry.

How your APR impacts your credit card debt?

The higher your APR on credit card balances, the more you will ultimately pay in interest charges over time. For example, leaving a $5,000 balance on a card with a 20% APR means you’ll pay almost $1,000 in interest alone each year until the debt is paid off.

A lower 16% rate could save over $200 annually on the same balance. Interest rates directly affect the bottom line cost of revolving balances.

Factors that can influence your credit card APR

Credit card companies base APR pricing on certain metrics:

The Fed

As the federal funds rate moves up and down, credit card rates may adjust accordingly within a couple of billing cycles.

Your Credit Health and Habits

Payment history, credit utilization, inquires, and derogatory marks impact a credit score, which issuers use to assess risk and price interest.

The End of your Introductory Period

Teaser rates typically expire within 6-18 months, reverting you to the higher standard variable purchase APR.

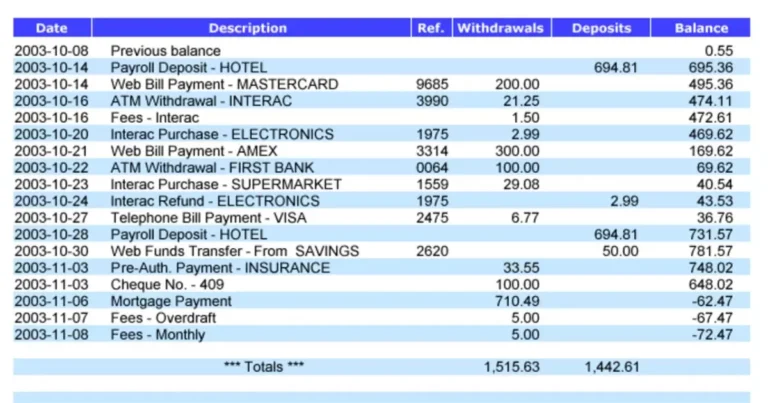

Where to find your APR?

Most monthly statements disclose the following rate types:

Introductory APR

A promotional benchmark rate for a set period, like 6 months at 0%.

Balance Transfer APR

The rate charged for amounts transferred from other cards.

Cash Advance APR

Higher fees for cash withdrawals versus purchases.

Penalty APR

Issuers may hike this rate for delinquency, exceeding limits, etc.

Can you ask your credit card company for a lower interest rate?

It’s always worth a polite inquiry to your issuer about lowering your standard APR if you have built a track record of solid on-time payments. Having an emergency fund and paying statements in full each cycle also strengthens your case by demonstrating low risk. Many issuers are receptive to current customers who manage their accounts responsibly. The worst they can say is no.

If your credit card issuer won’t lower your interest rate

Some additional options to consider:

Consider balance transfer card options

Look for new cards with 0% intro periods to migrate higher-rate balances cheaply for 12-21 months.

Make a plan to repay existing debt balances

Focus on paying extra each month towards the cards with the highest interest first via avalanche or snowball methods.

Keep a close eye on your score

Check periodically that you are optimizing credit utilization ratios and avoiding new applications for the best APR odds.

Keep the lines of communication open

Issuers may reassess customers after good payment patterns over time, so continue polite periodic requests.

FAQs

When can a Credit Card Adjust the APR?

Issuers have flexibility to change variable rates with proper advance notification, typically 30-45 days.

Under what Circumstances can a Credit Card Company Change your APR?

Reasons can include economy shifts, credit risk factors like late payments, exceeding credit limits, or ending intro periods.

Will a Credit Card Company lower my APR?

It depends on your individual profile, relationship history, and request merit according to issuer guidelines and discretion. Maintaining excellent standing increases chances.

How do Credit Card Companies Decide APR?

Risk-based pricing models weigh credit scores and payment behaviors primarily, along with account tenure, product type and overall portfolio management goals.

Conclusion

Managing credit card interest expenses requires ongoing vigilance by periodically checking APRs, credit reports, and open communication with issuers when balances loom. With strong payment records and creditworthiness, requesting better rates is an option to help save on debt over time within the rules set by each provider. Staying educated about rate adjustment policies puts cardholders in control.