What Is a P2 Truedly Transaction On Your Bank Statement?

A P2 Truedly transaction to your financial institution declaration is when you send or receive money at once to or from another person using an app or website. What is a P2 Truedly transaction in your bank statement? It’s like giving cash to a friend or getting cash from them, but it’s done electronically via your financial institution. So, rather than using cash, you use your smartphone or PC to move the cash. It’s quick, handy, and safe. Here we will explore the various scenarios that could result in these kinds of transactions appearing on your statement, including Hgb Prime Transaction, and help you understand them better.

key Takeaways about P2 Truedly Transaction

- P2 Truedly charges consult with digital payments or transfers that seem on statements with out clean context just like the merchant call.

- They generally represent valid bills but lack identifying info that confuse clients.

- Be sure to promptly look at any surprising P2 Truedly prices on credit playing cards to prevent costs or credit damage.

- Scenarios like credit score card theft records breaches or member of the family mistakes can bring about valid P2 Truedly costs.

- The Fair Credit Billing Act establishes dispute rights for unauthorized transactions like these thriller costs.

- Closely overview statements check online data and call your bank right away if any charges seem incorrect.

- Providing documentation helps disputes and enables investigations pass smoothly.

- Be vigilant common by means of monitoring statements frequently and practicing safe password and charge detail dealing with.

- Taking lively steps to apprehend and cope with unusual expenses like P2 Truedly transactions protects your money owed and credit score.

- What are P2 Truedly Charges?

- A P2 truedly transaction happens while a purchaser’s credit card is charged without permission. This means the client did not conform to or authorize the transaction. P2 refers to charges that clients say they did not permit.

- P2 truedly charges take place through mistake or illegally. Merchants may additionally post a further fee by means of accident. Criminals can also use stolen card details to make fraudulent purchases earlier than getting caught. It is essential for clients to test statements for any P2 truedly transactions.

What are P2 Truedly Charges?

A P2 truedly transaction happens while a purchaser’s credit card is charged without permission. This means the client did not conform to or authorize the transaction. P2 refers to charges that clients say they did not permit, often involving a USCC IVR Charge.

P2 truedly charges take place through mistake or illegally. Merchants may additionally post a further fee by means of accident. Criminals can also use stolen card details to make fraudulent purchases earlier than getting caught. It is essential for clients to test statements for any P2 truedly transactions.

P2 Truedly Charges on Credit Cards

Credit card corporations recall P2 truedly transactions as fees clients file they did no longer approve. The consumer disputes these payments. So the financial institution issuing the cardboard is first of all responsible except proven fraudulent.

If a purchaser complains about a P2 truedly transaction their card company usually refunds the cash within months. The bank will then inspect to peer if the rate changed into genuinely unapproved to decide if the refund continues applying.

Various Scenarios Leading to P2 Truedly Transactions

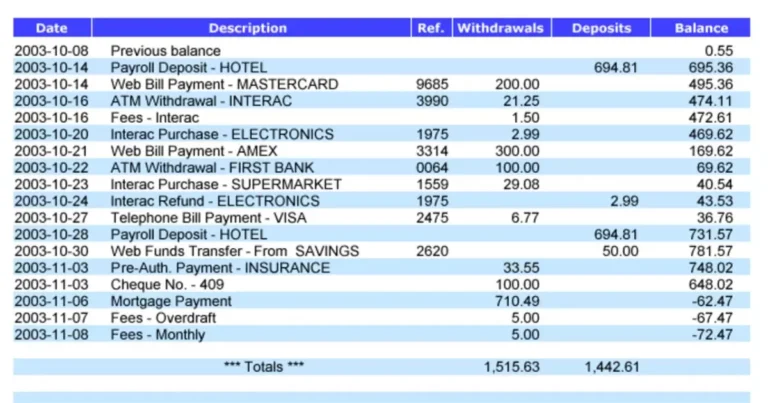

| Scenario | Description |

| Bill Payments | Paying utility bills online |

| Online Shopping | Buying items from e-commerce websites |

| Subscription Services | Subscribing to digital services like streaming platforms |

| Fund Transfers | Transferring money to friends or family through banking apps |

| Mobile Wallets | Using mobile payment apps for purchases |

| Loan Repayments | Repaying loans online |

| Investment Transactions | Buying or selling stocks or other investments |

| Membership Fees | Paying for club or association memberships online |

| Charity Donations | Donating to charities through online platforms |

| Service Fees | Paying service fees for online banking or other financial services |

Common motives for P2 truedly transactions are stolen card numbers used for fake on line purchases. Merchants may want to accidentally rate a patron two times. Also overseas sellers may fee in some other foreign money than agreed or at a exclusive fee.

Mistakes can happen like keying in an wrong keep buy amount higher than truth. Faulty fee machines may keep card information to wrongly charge later. Customers visiting internationally face higher risks of disputing questionable transactions.

Fair Credit Billing Act and its Significance

A US law called the Fair Credit Billing Act sets guidelines for credit score card statement disputes and blunders fixing. It makes banks acknowledge complaints about P2 truedly transactions within 30 days and clear up them inside statements.

This helps defend consumer rights and guarantees billing errors from either facet get addressed well. It also forces card issuers to fairly overview purchaser claims of unauthorized expenses as opposed to always siding with traders.

How to Detect P2 Truedly Charges?

One way to find tricky charges is to very well overview statements each month for any transactions that appear unfamiliar. Note such things as quantities, dates and service provider information listed.

Watch for repeating fees from businesses no longer used. Check charges healthy receipts. Right away report lost or stolen cards to prevent fraudulent pastime. Careful opinions assist identify questionable P2 truedly transactions desiring dispute.

Merchant Identification

When disputing charges have a look at the named service provider or supplier. Well recognised brands normally have recognizable business enterprise identities. Smaller shops can list indistinct dealer names making disputing strange fees harder for the reason that supply remains doubtful.

Transaction Details

Also test dates codes and different listed specifics for every transaction. Unexpected statistics like declined bills dealt with as approvals or widely wide spread codes may additionally flag capacity unauthorized activity desiring investigation. Receipts aid in confirming or questioning expenses. For example you might stumble upon unusual phrases what’s a P2 Truedly transaction in your bank announcement? This kind of inquiry can help pick out and clarify questionable entries ensuring all transactions are legitimate and understood.

Report to your Bank

Immediately touch the credit score card complaints team in case you word an unauthorized P2 truedly transaction that should be removed. Explaining you don’t apprehend a fee permits them to rapid procedure a provisional refund whilst looking into details. Most issuers receive disputes on line by means of telephone or mail.

How to Avoid Unauthorized Charges?

Consumers can lessen fraud dangers by way of using passwords competently opting out of sharing personal information reviewing statements promptly the use of credit over debit for big buys securely shredding receipts rapidly reporting misplaced cards and heading off public Wi Fi for sensitive activities. Good protection conduct make P2 truedly transactions much less probably to occur.

Proper precautions combined with vigilantly checking statements enables ensure charging mistakes receive brief handling and questionable P2 truedly transactions get addressed because the regulation calls for thru the issuer’s dispute process. This protects purchasers from being made to pay for purchases they are able to display lacked legal approval.

How do you Identify an Unknown Transaction?

When a random rate pops up start with move checking its date towards latest receipts. If dates don’t suit the fee may be fraudulent. Also analyze the service provider name research it on line or question your financial institution for clarity if the vendor remains difficult to understand.

Similarly investigate to be had codes as the ones link to specific payment networks. Details like names dates and codes help determine if investigating the transaction as a capability P2 truedly dispute makes sense or it changed into sincerely legal.

How do I Find out Where a Charge Came From?

Closely have a look at merchant names and any emblems or descriptions that could monitor the rate’s source. Searching a indexed business name on line may additionally yield useful organisation statistics supporting pick out the store.

But if self studies fails right away touch your credit card issuer. Provide to be had transaction specifics for them to make use of equipment tracing suspect expenses again thru networks to their root supply permitting disputes for truly unrecognized P2 truedly transactions.

Merchant Names may be Different on Your Bill

Statements from time to time shorten merchant names or listing them differently than bodily locations display. Especially not unusual for smaller impartial stores versus national chains.

Save all receipts in case an unfamiliar call outcomes from an abbreviation as opposed to an real fraudulent P2 truedly transaction. Receipts function valuable references if ever had to make clear a price being disputed.

What you Should do If You Don’t Recognize a Charge?

First try at once contacting the listed enterprise yourself with well mannered questions. See if in addition info help apprehend the purchase. If direct questions do not resolve the uncertain charge right now call your card company’s lawsuits team without delay. Report it as an unauthorized P2 truedly transaction for them to check out directly on your behalf at the same time as issuing provisional credit score if applicable. But do not wait to document questionable costs.

Frequently Asked Question

Conclusion

Seeing unexpected transactions like what’s a P2 truedly transaction in your bank declaration? For your financial institution declaration may be puzzling. It is usually exceptional to invite your bank for an evidence of any doubtful prices rather than count on the worst. With some simple conversation these mysteries may be solved. Maintaining open communication together with your bank allows you to recognize your declaration better and make sure all fees are honestly yours.