Wdroyo Insurance| A Comprehensive Guide

Wdroyo Insurance is a trusted provider offering comprehensive insurance solutions tailored to meet diverse needs. With a commitment to customer satisfaction and a focus on personalized service. It strives to provide peace of mind through reliable coverage options. Whether it’s safeguarding your assets securing your future or protecting your loved ones. It is dedicated to delivering quality protection and support to its valued clients.

Kinds of Insurance Policy Used by Wdroyo

Wdroyo being a fictional entity could potentially use a variety of insurance policies depending on its specific needs and circumstances. Here are some common types of insurance policies that individuals or businesses might consider:

Property Insurance:

This type of insurance covers damage to or loss of property including buildings equipment and inventory. Wdroyo might consider property insurance to protect its physical assets.

Liability Insurance:

Liability coverage affords insurance for criminal claims in opposition to the insured for physical damage or assets harm triggered to others. Wdroyo may opt for legal responsibility coverage to defend itself from ability court cases.

Health Insurance:

Health insurance covers medical expenses incurred by the insured including hospitalization surgery and prescription drugs. Wdroyo might offer health insurance as part of its employee benefits package.

Life Insurance:

Liability insurance offers insurance for crook claims in opposition to the insured for bodily damage or assets harm brought on to others. Wdroyo might also choose criminal duty coverage to shield itself from potential courtroom cases.

Advantages of Picking WDROYO Insurance Policy

here’s a simple table highlighting five advantages of picking a WDROYO insurance policy.

| Advantages | Description |

| Wide Coverage | Wdroyo insurance offers extensive coverage. It includes protection for various risks and unforeseen events. |

| Competitive Premiums | The policy offers competitive premiums. It ensures affordability without compromising on coverage. |

| Deductible Options | Wdroyo provides flexible deductible options allowing policyholders to customize their coverage as per their needs and budget. |

| Responsive Customer Service | Access to responsive customer service ensures quick assistance and support during emergencies or inquiries. |

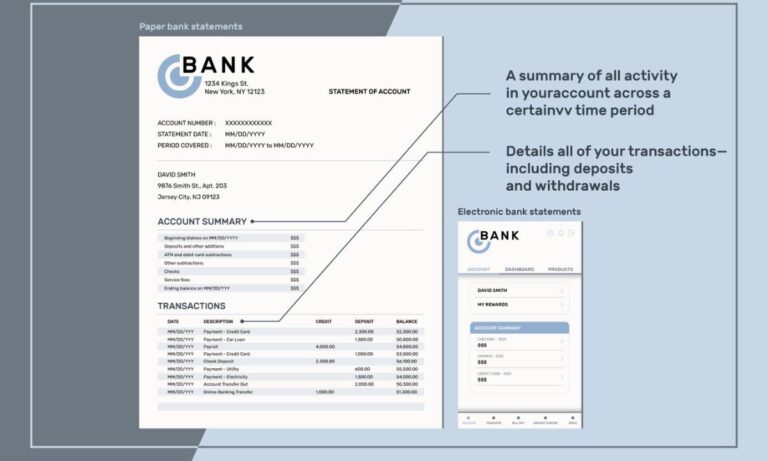

| Online Access and Management | Convenient online platforms allow easy policy management claims processing and access to important documents anytime or anywhere. |

Exactly How WDROYO Stands Out in the Insurance Coverage Market

WDROYO a hypothetical insurance company could stand out in the insurance coverage market through several strategic approaches.

Customized Policies:

Offering highly customizable insurance policies tailored to individual needs can set WDROYO apart. By providing options for customers to select coverage specific to their requirements. They can ensure clients get precisely what they need without paying for unnecessary extras. To close a Robinhood account one can follow the steps outlined on the platform’s website typically located in the account settings or support section.

Innovative Technology:

Implementing cutting edge technology can streamline processes and enhance the customer experience. For instance using AI powered chatbots for customer service mobile apps for policy management or telematics for usage based insurance can differentiate WDROYO from traditional insurers.

Focus on Customer Service:

Exceptional customer service can be a significant differentiator in the insurance industry. WDROYO can prioritize quick and efficient claims processing 24/7 support and personalized assistance to build trust and loyalty among customers.

Competitive Pricing:

Offering competitive pricing while maintaining quality coverage is crucial. WDROYO can leverage data analytics to price policies accurately and fairly. It ensures customers get the best value for their money.

Specialized Coverage:

Providing specialized insurance coverage for niche markets or unique risks can attract specific customer segments. Whether it’s pet insurance event insurance or cyber insurance.

Making Enlightened Decisions: Picking the Right Insurance Coverage

Making enlightened choices when selecting insurance insurance involves thorough research and cautious consideration of your desires. It’s essential to assess your risks and understand what each type of insurance offers.

Start by evaluating your current situation and future goals to determine the level of coverage required. Comparing quotes from multiple insurers can help find the best value for your money. Don’t forget to review the policy terms. It includes deductibles coverage limits and exclusions to make certain they align together with your expectancies.

Benefits and Features of WDROYO Insurance

WDROYO Insurance provides many advantages for e commerce businesses over traditional insurance models. They offer a wide variety of customizable coverage options such as liability property and business interruption policies that can be easily bundled together for added savings.

Flexible Coverage Options

WDROYO offers liability equipment damage, business interruption and other customizable policies. Plans can be bundled for savings.

Easy Online Management

The entire insurance lifecycle from quoting to claims is handled digitally through an easy-to use online portal.

24/7 Claims Services

In case of an insured incident, licensed adjusters are available around the clock for fast claims processing.

Risk Management Tools

Insurtech tools help identify risks and improve safety practices to prevent or reduce future losses.

Competitive Pricing

Streamlined digital operations let WDROYO pass on average 20% savings versus traditional insurers. Rates often beat broker quotes.

Specialized Expertise

As a Insurtech startup WDROYO understands e-commerce and provides tailored coverage for online seller needs.

Loyalty Rewards

Premium discounts are offered for maintaining claims free policies with WDROYO over multiple periods.

Financial Security

All policies are backed by A rated insurers ensuring protected, licensed insurance even if WDROYO is acquired.

Insures Claims Process with WDROYO

The Insured Claims Process with WDROYO is a streamlined and efficient machine designed to simplify the coverage claims system. With WDROYO policyholders can file claims quickly and easily online reducing paperwork and hassle.

The platform utilizes advanced technology to expedite claim processing to ensuring that customers receive prompt assistance during stressful times. By integrating automation and user-friendly interfaces WDROYO enhances customer satisfaction and facilitates smoother interactions between insurers and policyholders.

WDROYO Insurance and Consumer Complete Satisfaction

WDROYO Insurance our top priority is ensuring complete satisfaction for every consumer. We understand that insurance needs vary so we offer a wide range of customizable policies tailored to fit your specific requirements.

Whether it’s auto home health or life insurance we’re committed to providing reliable coverage and exceptional customer service. With WDROYO you can trust that you’re not just getting insurance you’re getting peace of mind.

Tips For Reducing Premiums with WDROYO

Here are some easy short tips for reducing premiums with WDROYO:

Shop Around: Compare quotes from multiple insurers to find the best premium rates.

Bundle Policies: Consider bundling multiple insurance policies with the same provider for potential discounts.

Review Coverage Needs: Regularly assess your coverage needs to avoid over insuring which can lead to higher premiums.

Maintain Good Credit: A healthy credit score can often result in lower insurance premiums.

Increase Deductibles: Opt for a higher deductible if you can afford it as this typically leads to lower premiums.

WDROYO’S Commitment to Community and Social Obligation

WDROYO has always prioritized its commitment to community and social obligation. With a steadfast dedication to making a positive impact WDROYO consistently engages in various initiatives aimed at uplifting communities and fulfilling its social responsibilities.

Through partnerships donations and volunteer efforts WDROYO actively contributes to local causes educational programs and environmental sustainability projects. By fostering a culture of giving back. WDROYO not only strengthens its bonds with the community but also inspires others to join in creating a brighter more inclusive future for all.

The Future of WDROYO Insurance Policy

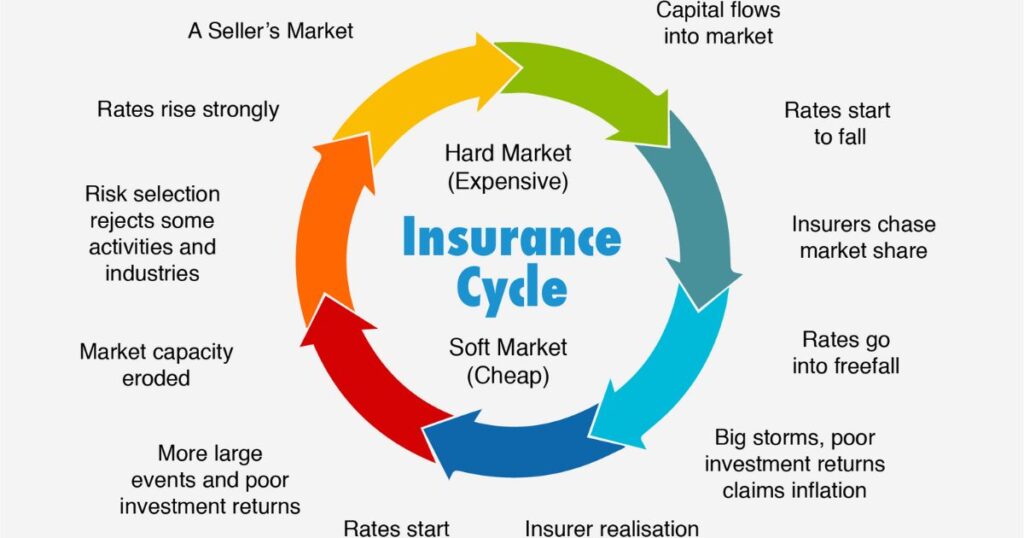

In the future WDROYO Insurance Policy is set to revolutionize the insurance industry. WDROYO will offer hyper personalized policies tailored to individual needs reducing premiums and maximizing coverage.

Utilizing blockchain technology claims processing will become seamless and transparent. It ensures quick settlements and minimal paperwork. WDROYO will pioneer sustainability focused insurance products incentivizing eco friendly behaviors and promoting a greener future.

Typical Misconceptions Concerning WDROYO Insurance Coverage

One common misconception about WDROYO insurance coverage is that it only protects against water damage caused by floods. WDROYO insurance typically covers a broader range of water related incidents.

It includes burst pipes sewer backups and even damage from heavy rains. Another misconception is that WDROYO insurance is only necessary for homeowners in flood prone areas. Water damage can occur in any home whether it’s due to a sudden plumbing issue or an appliance malfunction.

Professional Viewpoints on WDROYO Insurance

Professional viewpoints on WDROYO insurance vary but many experts emphasize its importance in safeguarding businesses against unexpected losses due to natural disasters or liability claims. Some view it as a crucial risk management tool providing financial protection and peace of mind to businesses of all sizes.

Others stress the importance of carefully assessing coverage options and understanding policy terms to ensure adequate protection tailored to specific needs. Professionals generally agree that WDROYO insurance plays a vital role in mitigating risks and promoting business continuity.

Easy Access to Customer Support and Claim Filing Processes

It is essential for a seamless customer experience. With user friendly interfaces and readily available assistance customers can quickly navigate through any issues they encounter. Simplified claim filing procedures further enhance convenience.

It allows customers to efficiently report any concerns or file claims with minimal hassle. By prioritizing accessibility and efficiency in customer support and claim filing. Businesses demonstrate their commitment to meeting customer needs promptly and effectively fostering trust and satisfaction among their clientele.

Regulatory Compliance and WDROYO Insurance

Regulatory compliance is a top priority for WDROYO Insurance. All insurance policies are underwritten by major carriers that are licensed to operate in the appropriate jurisdictions and adhere to respective insurance laws and regulations.

Licensed Insurance Carriers

All insurance policies are underwritten by major carriers with valid operating licenses in applicable jurisdictions.

Adherence to Regulations

WDROYO and its partners strictly follow insurance laws and regulations related to solvency, consumer protection, data privacy and claims handling.

Certified Coverage Documents

Policy terms and conditions are pre-approved by regulators to ensure full regulatory compliance from an insurance perspective.

Secure Data Handling

Customer information is securely collected, processed and stored per privacy standards like GDPR and ISO.

Audited Financials

Carrier finances supporting WDROYO policies undergo regular auditing to guarantee ability to pay valid claims.

Access to Oversight

Policyholders can contact regulators directly to address any compliance related issues as needed.

Frequently Asked Questions

What does WDROYO Insurance Cover?

WDROYO Insurance provides coverage for a wide range of needs including auto home life and health insurance. They offer coverage for businesses and specialty insurance like pet insurance.

How can I file a claim with WDROYO Insurance?

Filing a claim with WDROYO Insurance is easy and convenient. You can typically file a claim online through their website or mobile app or you can contact their customer service hotline for assistance.

Does WDROYO Insurance Offer Discounts?

Yes WDROYO Insurance offers various discounts to help you save on your premiums. These discounts may include multi policy discounts safe driver discounts and discounts for certain professions or affiliations.

Is WDROYO Insurance Available Nationwide?

Yes WDROYO Insurance operates in multiple states across the country providing coverage to individuals families and businesses nationwide.

How can I Contact WDROYO Insurance for Assistance?

You can reach WDROYO Insurance customer service representatives by phone email or through their website’s live chat feature. They’re available to assist you with any questions concerns or policy needs you may have.

Conclusion

WDROYO Insurance stands out as a reliable choice for individuals and businesses seeking comprehensive coverage. With its diverse range of policies tailored to various needs coupled with exceptional customer service and competitive rates. WDROYO Insurance emerges as a trusted partner in safeguarding against unforeseen risks. It’s protecting assets health or peace of mind.